Wednesday, February 28, 2018

Tuesday, February 27, 2018

Monday, February 26, 2018

Friday, February 23, 2018

Thursday, February 22, 2018

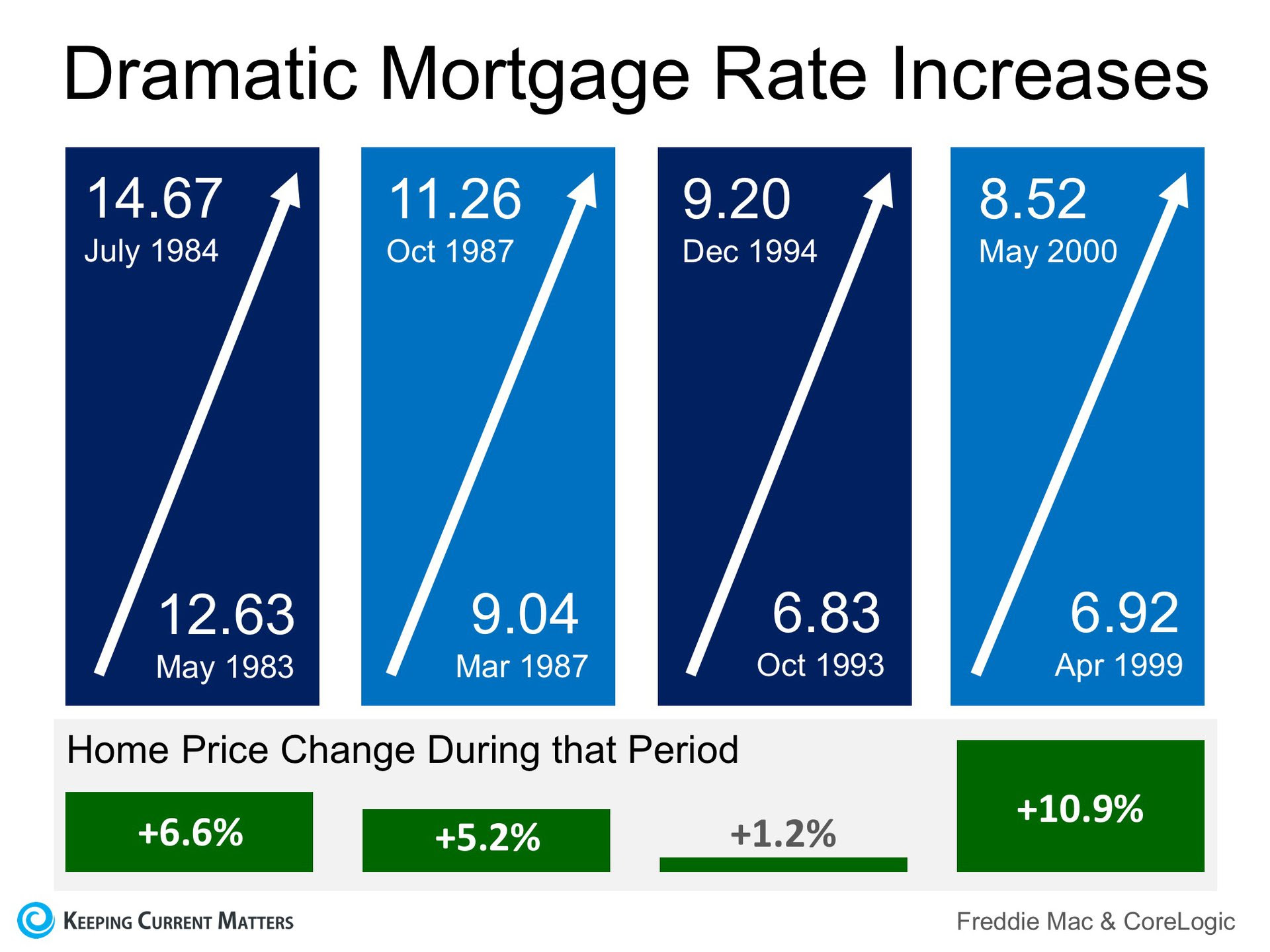

Mortgage Rates on FIRE! Home Prices Up in Smoke?

Mortgage interest rates have already risen by over a quarter of a percentage point in 2018. Many are projecting that rates could increase to 5% by the end of the year.

What impact will rising rates have on house values?

Many quickly jump to the conclusion that an increase in mortgage rates will have a detrimental impact on real estate prices as fewer buyers will be able to qualify for a loan. This seems logical; if there is less demand for housing then prices will drop.However, in a good economy, rising mortgage rates increase demand as many prospective purchasers immediately jump off the fence to guarantee they get the lower rate.

Let’s look at home prices the last four times mortgage rates increased dramatically.

In each case, home prices APPRECIATED and did not depreciate. No one is projecting as dramatic an increase in rates as the examples above. Most are projecting an increase of approximately 1% by the end of the year.

The last time mortgage rates increased by 1% over a twelve-month period was January 2013 (3.41%) to January 2014 (4.43%). What happened to house prices during that span? They appreciated by 9.8%.

Just two weeks ago, Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting explained:

“Mortgage rates have risen 1% or more ten times in the last 43 years, with little impact on home sales and prices when the economy was also strong…Historically, rising confidence, solid job growth, and higher wages have more than offset reduced demand for housing resulting from higher mortgage rates.”

Bottom Line

When mortgage rates increase, history has shown that prices appreciate (and do not depreciate) during that same time span.

Wednesday, February 21, 2018

How Buyers Misjudge the Mortgage Process

Many home buyers find the mortgage process “stressful” or “complicated,” recent surveys show. As such, they may go through it and make some mistakes they later regret. Realtor.com® recently highlighted some of consumers’ most common pitfalls when getting a mortgage, including:

Failing to shop around.

About half of home buyers say they meet with only one mortgage lender before signing up for a mortgage, according to the Consumer Financial Protection Bureau. Lenders’ interest rates and offers can vary. Failing to talk with more than one mortgage lender may mean buyers miss out on some savings. Rates among lenders can vary by more than a half percentage, according to the CFPB. For example, getting a 4 percent rate on a 30-year fixed-rate mortgage compared to a 4.5 percent rate on a $200,000 loan could mean a savings of about $60 per month or $3,500 over the first five years. Housing experts recommend meeting with at least three mortgage lenders before selecting one.

Waiting for a 20 percent down payment.

A 20 percent down payment can help home buyers avoid having to pay the extra fees of private mortgage insurance. But mortgage rates are currently still at historical lows and waiting for a 20 percent down payment could mean buyers miss a chance to lock in a lower mortgage rate.

Getting prequalified instead of preapproved.

Prequalification is a basic overview a lender does of a borrower’s ability to get a loan. Buyers receive a general estimate of the size of loan they can afford. But it’s not a guarantee they can actually get approved for a home loan. That’s what makes a mortgage preapproval more ideal for home shoppers. It’s a more critical analysis by a lender of a buyer’s credit and assets. Lenders will then issue a letter of preapproval, which is a written commitment for financing up to a certain loan amount.

Shuffling money around accounts.

Buyers can run into delays when they start moving their money around from account to account. Lenders will check to see if finances have remained the same. Shuffling money around can be a huge red flag, says Casey Fleming, mortgage adviser and author of The Loan Guide: How to Get the Best Possible Mortgage. Buyers who are under contract for a home need to make sure their money stays put.

View more mistakes buyers most often make in the mortgage process at realtor.com®.

Source: “6 Ways Home Buyers Mess up Getting a Mortgage,” realtor.com® (Feb. 19, 2018)

Tuesday, February 20, 2018

When faulty data, lazy methodology and unresponsive and uncaring corporations meet the consumer loses. As always, if you have any questions at all or if you would prefer to speak to an actual real estate agent instead of an inaccurate website, please don't hesitate to let me know - I'm happy to help! www.timgrissett.com

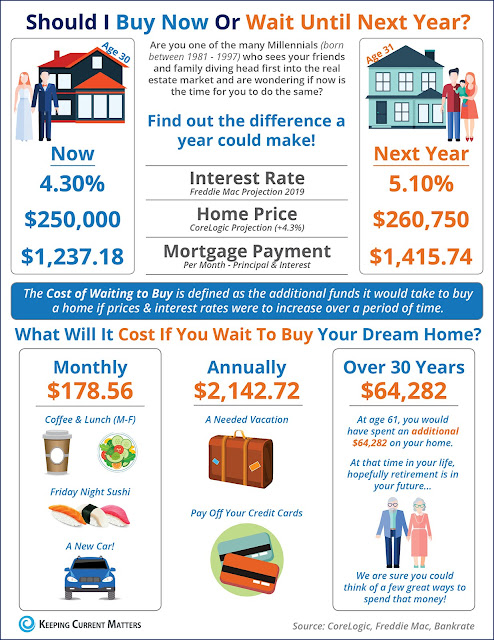

Should I Wait Until Next Year to Buy? Or Buy Now?

Some Highlights:

- The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time.

- Freddie Mac predicts interest rates to rise to 5.1% by 2019.

- CoreLogic predicts home prices to appreciate by 4.3% over the next 12 months.

- If you are ready and willing to buy your dream home, find out if you are able to!

Friday, February 16, 2018

Calm Down! The Real Estate Market is NOT Falling Apart

There has been tremendous volatility in certain markets over the last few weeks (for example, the stock and currency markets). When this happens, some tend to lump all of their investments together and create an almost ‘Armageddon’ scenario where everything loses value quickly and dramatically. Real estate is an investment that can get caught up in this hysteria. Does the concern about the current housing market have merit?

Financial advisors have been warning us for months that the stock market was ripe for a “correction.”

Experts have been questioning the value of alternative currencies for over a year.

In contrast, here are the opinions of three major players in the residential housing market:

Ralph DeFranco, Chief Economist, Arch Capital Services Inc.

“It’s premature to worry about a housing bubble. The typical warning signs – excessive debt levels, poor quality loans, exponentially increasing home prices, rising vacancy rates and/or poor affordability compared to the past, and a high number of internet searches on house flipping – are not present.”

Liu-Down, Genworth Chief Economist

“My thoughts on many recent discussions of ‘housing bubble’ – the bar for a housing bubble is higher than just prices being above some fundamental value. There must be widespread behavior change as well such as higher levels of fraud and speculation.”

Fitch Report

“US home prices are on track for a 5% nominal gain for the 4th consecutive year, returning national prices to their highest level since 2007. The growth has been driven by historically low mortgage rates and unemployment plus solid population and personal income growth rates…a meaningful correction should only be triggered by an unexpected economic shock.”

Bottom Line

Speculation has driven certain markets over the last year. However, it has not been speculation, but instead people’s desire for homeownership, that has driven the real estate market.

Thursday, February 15, 2018

Tuesday, February 13, 2018

Monday, February 12, 2018

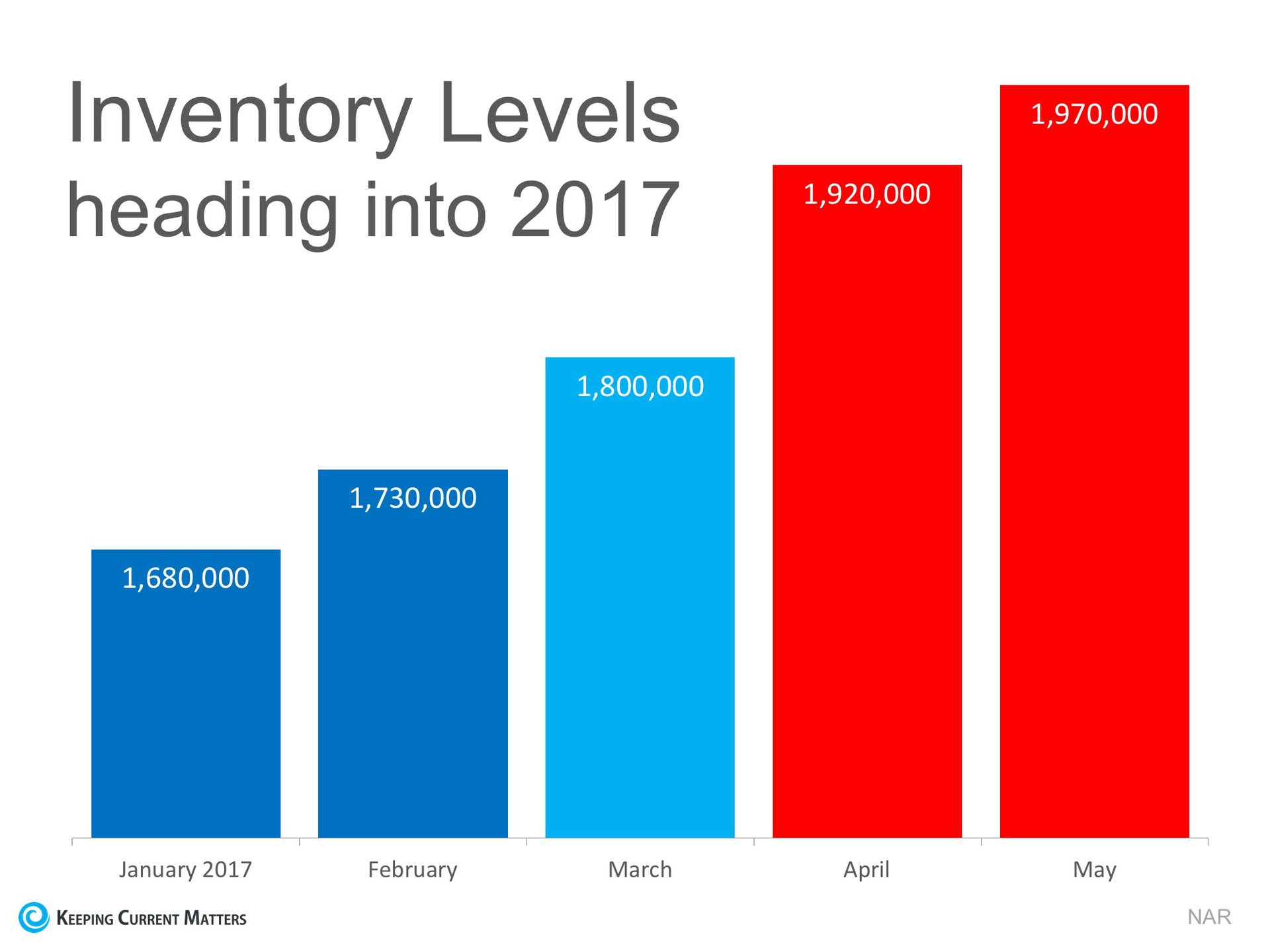

The #1 Reason to Sell Now Before Spring

The price of any item (including residential real estate) is determined by ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.

According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increases every spring. As an example, here is what happened to housing inventory at the beginning of 2017:

Putting your home on the market now instead of waiting for increased competition in the spring might make a lot of sense.

Bottom Line

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

Friday, February 9, 2018

Thursday, February 8, 2018

Wednesday, February 7, 2018

6 Things Your Home Stager Wishes You Knew

If you've never seen the work of professional stagers—those magical designer/decorators charged with making your house more marketable—prepare to be mystified, enthralled, and maybe a bit scared.

Did we say "scared"? Prepping your home for getting the best offer possible means removing every shred of your personality from rooms, walls, floors, and ceilings so that potential buyers can imagine themselves in your place. Stagers favor neutral walls, simple layouts, and minimal artwork. (No purple living rooms or gallery wall allowed!)

"There's a big difference between designing for someone's tastes and remerchandizing a home to appeal to as many people as possible," says Kathy Burke of Sensational Home Staging in Danville, CA. Getting it right is a critical and enigmatic art. Don't panic! We got some stagers to reveal their secrets to help you navigate the process.

1. Don't take it personally

We know you love the way you set up your living room. That eclectic collection of wicker baskets from all your European travels stacked up in the corner? It's the perfect detail for you—but not for your stager. Not even close.

So here's the thing: When they tell you what to change (and they absolutely will), don't be offended. It doesn't mean they think your style is awful. Not necessarily, anyway.

"It's not about whether I like something or not," Burke says. "It's about how we're going to present it. I know what photographs well and what looks dated."

Her favorite clients are the ones who know tough feedback is coming and don't care: “I walk in and they say, ‘You can't hurt my feelings. Do whatever you want.’”

2. Toss your stuff, and disconnect emotionally

For many sellers, home staging will be the first time they realize they're really, actually moving. Family pictures come down, the sofa goes into storage, and suddenly this place you called yours is looking less and less like you.

If you need to do some emotional processing, we understand: It's hard to put your family home on the market. But don't subject your stager to your stress. Detach. Chill out. Help the process, don't hinder or fight it. Keep your eye on the prize: selling your home at the right price, to the right buyers, within the right time frame.

What does that really mean? Try removing as much of your stuff as possible before the stager comes. By tackling spring cleaning you'll not only accomplish some necessary decluttering before your move, but you'll also get used to the idea that this is no longer your home.

"We need to make sure that they're truly ready to sell their house," says David Peterson of Synergy Staging based in Portland, OR. "That's a big part of emotionally disconnecting."

3. Move out (if you can)

Both Peterson and Burke find staging a home vastly easier when it's vacant. If you can afford to move out when the home goes on the market, do it.

"It's easier for them, it's easier on their pets, and it's easier on the buyer," Burke says. "We can create one cohesive look and don't have to blend anything."

Occupied houses present more of a challenge (and take substantially more time): Stagers have to accommodate daily living, as well as risk the homeowner not preserving their layout (or any rented furniture).

Occupied homes can even cost more to stage. "It's just a lot more work, timewise, when the owners are still living in the place," Burke says.

4. Stay out of the picture(s)

According to the 2014 Profile of Home Buyers and Sellers, 92% of buyers use the Internet to look for homes—meaning the pictures posted alongside your home's listing are wildly important.

"Much of what I'm doing is to appeal to people through photographs," Burke says. "I hope that photo will touch people and they’ll say, ‘That’s going on my short list.’”

Peterson aims to be the "last person in before the photographers. We want those pictures to look great."

But no one wants the buyers to be disappointed with the home's real-life presentation after seeing photos online. So here's a bonus: If you're staying in the property, make sure to keep it in tiptop shape.

5. Get your money’s worth

Staging isn't a last-minute addition before your home officially goes on the market. Stagers work far in advance and can't always fit in last-minute work. Costs start around $1,250, depending on your state of residence, square footage, and what—if any—furniture you rent, according to the Real Estate Staging Association.

That might seem like a lot of money to spend on a home you're about to sell, but both Burke and Peterson say staging is an investment with a very high return. "Anything we put in, we want to make sure you're getting your money back," Burke says.

6. Stay on schedule

Don't dillydally on making the recommended changes for your stager, who can't begin rearranging until you've finished renovating. Usually the requested changes are small (new paint, fixing chipped tiles in the bathroom, etc.).

Not finishing small jobs on time can push the entire project back.

"If we get there and a place hasn't been cleaned, or there's still a painting crew, we can't do our jobs. Then we have to charge them a fee, leave, and then reschedule," Peterson says. "If we're booked out several weeks, it really makes it hard." And maybe even more expensive. So get moving.

Tuesday, February 6, 2018

Home Staging Tip #1

Demand for your home is very strong right now while your competition (other homes for sale) is at a historically low level. If you are thinking of selling in 2018, now may be the perfect time. www.timgrissett.com

Monday, February 5, 2018

Friday, February 2, 2018

Thursday, February 1, 2018

Bidding Wars Abound... How Long Will They Continue?

Just like with any product or service, the law of supply and demand impacts home prices. Any time that there is less supply than the market demands, prices increase.

In many areas of the country, the supply of homes for sale in the starter and trade-up home markets is so low that bidding wars have ensued, and the busy spring-buying season is just around the corner.

CoreLogic recently conducted an analysis on national home prices at the time of sale for their January 2018 MarketPulse Report and found that a third of homes sold for at least list price.

“The share selling above list price was almost three times the trough in January 2008 and represented more than one-fifth of total sales.”Many markets in the western part of the country and around major cities are experiencing higher shares of homes selling above list price.

“San Francisco had the largest share of homes—76 percent—that sold for at least the list price, and Seattle and Los Angeles followed with 63 and 51 percent, respectively. Miami had the lowest share—16 percent—of homes selling at or above the list price.”Increased demand during the spring and summer months, the traditionally busier seasons for real estate, will no doubt influence how many homes continue to sell over list price.

This should not be seen by sellers as permission to overprice their homes, though. Buyers are becoming more and more educated, especially those who have been searching for their dream homes for a while now while waiting for new inventory to come to market.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

Bottom Line

Without a large wave of new listings coming to market, buyers will continue competing with each other for the homes that are available. If you are thinking of selling your home, now may be the time to do so before more competition comes this spring. Contact a local real estate professional who can help you determine the demand for your house in your area.

Subscribe to:

Comments (Atom)