The housing market has been anything but normal for the last eleven

years. In a normal real estate market, home prices appreciate 3.7%

annually. Below, however, are the price swings since 2007 according to

the latest

Home Price Expectation Survey:

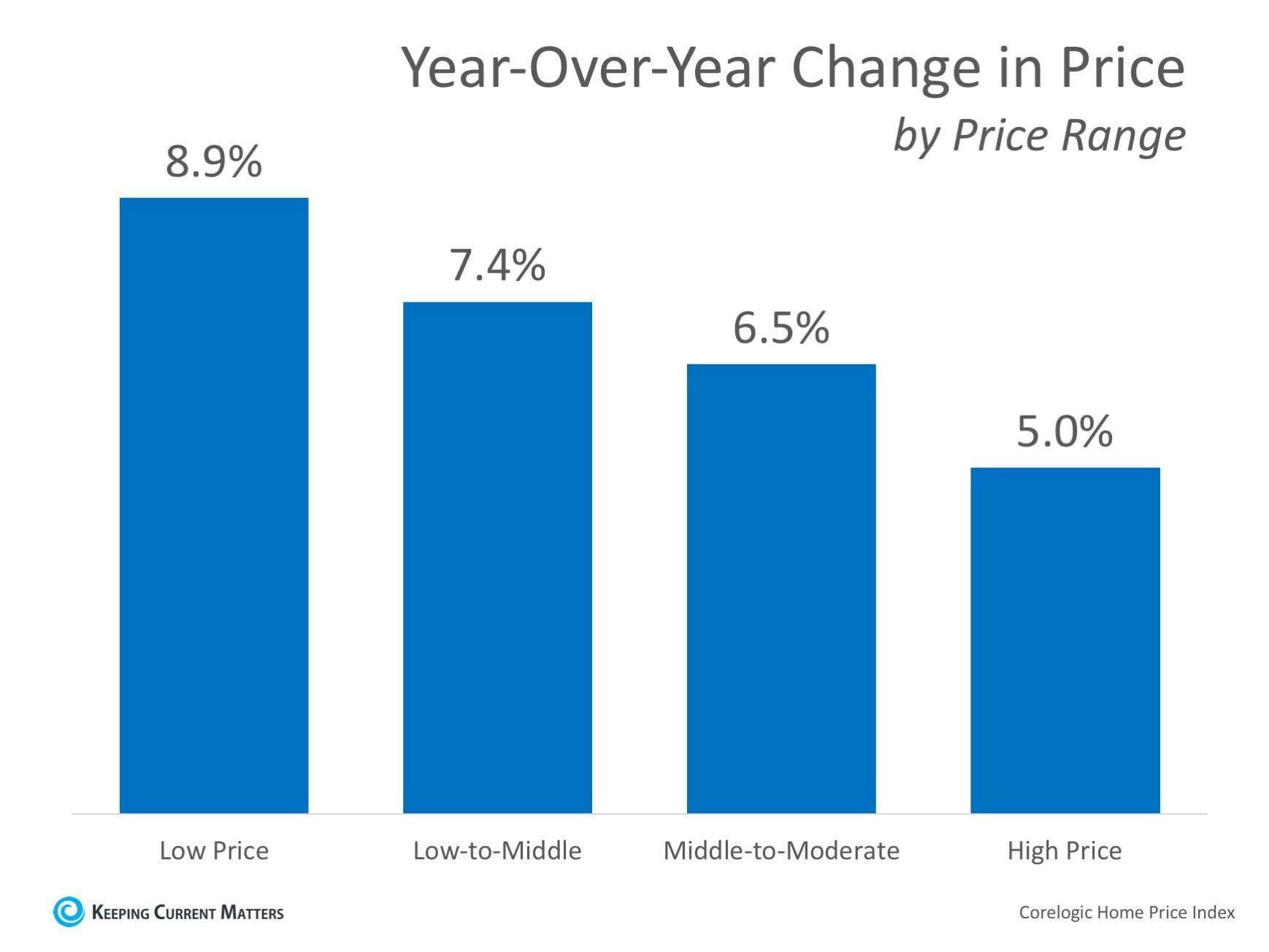

After the bubble burst in June 2007, values

depreciated 6.1% annually until February 2012. From March 2012 to today, the market has been recovering with values

appreciating 6.2% annually.

These

wild swings in values were caused by abnormal ratios between the

available supply of inventory and buyer demand in the market. In a

normal market, there would be a 6-month supply of housing inventory.

When the market hit its peak in 2007, homeowners and builders were trying to take advantage of a market that was fueled by an

“irrational exuberance.”

Inventory

levels grew to 7+ months. With that many homes available for sale,

there weren’t enough buyers to satisfy the number of homeowners/builders

trying to sell, so prices began to fall.

Then, foreclosures came

to market. We eventually hit 11 months inventory which caused prices to

crash until early 2012. By that time, inventory levels had fallen to

6.2 months and the market began its recovery.

Over the last five

years, inventory levels have remained well below the 6-month supply

needed for prices to continue to level off. As a result, home prices

have increased over that time at percentages well above the appreciation

levels seen in a more normal market.

That was the past. What about the future?

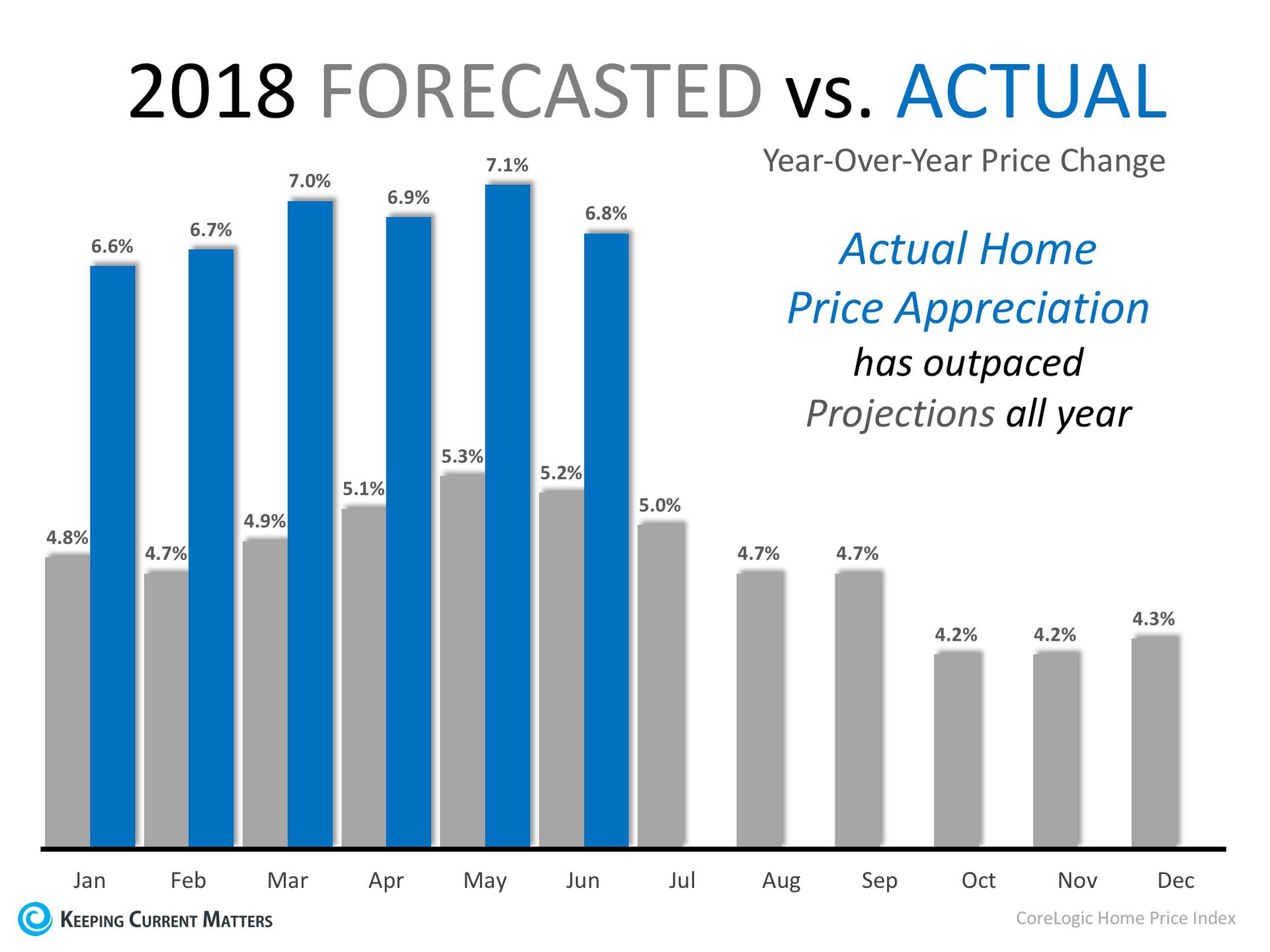

We

currently have about 4.5-months inventory. This means prices should

continue to appreciate at above-normal levels which most experts believe

will happen for the next year. However, two things have just occurred

that are pointing to the fact that we may be returning to a more normal

market.

1. Listing Supply is Increasing

Both existing and new construction inventory is on the rise. The latest

Existing Home Sales Report from the

National Association of Realtors

revealed that inventory has increased over the last two months after

thirty-seven consecutive months of declining inventory. At the same

time,

building permits are also increasing which means more new construction is about to come to market.

2. Buyer Demand is Softening

Ivy Zelman, who is widely respected as an industry expert, reported in her latest

‘Z’ Report:

“While we continue to expect a resumption of

growth in resale transactions on the back of easing inventory in 2019

and 2020, our real-time view into the market through our Real Estate Broker Survey

does suggest that buyers have grown more discerning of late and a level

of “pause” has taken hold in many large housing markets.

Indicative of this, our broker contacts rated buyer demand

at 69 on a 0- 100 scale, still above average but down from 74 last year

and representing the largest year-over-year decline in the two-year

history of our survey.”

With supply increasing and demand waning, we may

soon be back to a more normal real estate market. We will no longer be

in a buyers’ market (like 2007-February 2012) or a sellers’ market (like

March 2012- Today).

Prices won’t appreciate at the levels we’ve

seen recently, nor will they depreciate. It will be a balanced market

where prices remain steady, where buyers will be better able to afford a

home, and where sellers will more easily be able to move-up or

move-down to a home that better suits their current lifestyles.

Bottom Line

Returning

to a normal market is a good thing. However, after the zaniness of the

last eleven years, it might feel strange. If you are going 85 miles per

hour on a road with a 60 MPH speed limit and you see a police car ahead,

you’re going to slow down quickly. But, after going 85 MPH, 60 MPH will

feel like you’re crawling. It is the normal speed limit, yet, it will

feel strange.

That’s what is about to happen in real estate. The

housing market is not falling apart. We are just returning to a more

normal market which, in the long run, will be much healthier for you

whether you are a buyer or a seller.