Friday, November 30, 2018

Thursday, November 29, 2018

Wednesday, November 28, 2018

Gift of Equity

There is a little-known mortgage program that could provide the vehicle for the right person to get into a home. If a person sells their home to another for less than the fair market value, the difference in the appraised value and the sales price is considered a gift of equity for the buyer.

FHA requires that borrowers receive gifts of equity only from family members transferring title to the borrower.

An appraisal is required to determine the value of the home. The sales price is subtracted from the appraised value to determine the equity to be gifted. If a home appraises for $300,000 when the owner will sell it for $250,000, the gift is $50,000.

The gift is applied to the down payment. In this example, the borrower would have to qualify for a $250,000 mortgage which would require private mortgage insurance because a 20% down payment on a $300,000 home would be $60,000. If the buyer had an additional $10,000 in cash to put down, the PMI would not be required, and the monthly payments would be lower.

The seller would need to provide a gift letter stating the amount of the gift, the date the gift, and that no repayment is expected or required. It also needs to have the donor's name, address, phone, email and relationship to the buyer. In addition, the settlement statement will need to show the gift being credited from the seller to the buyer. The lender may require additional documentation.

Beginning in 2018, the annual gift tax exemption is increased to $15,000 per person per year and lifetime exemption to $5.6 million. The fact that the $50,000 exceeds the individual amount doesn't mean there will necessarily be any gift tax due now. The seller should consult their tax professional.

Tuesday, November 27, 2018

Monday, November 26, 2018

Wow Your Guests! Fun Holiday Decorating Ideas

Start outside

A wreath on the front door is classic and

timeless. A pine or boxwood wreath is always beautiful—or dare to be

different. Opting for a wreath of fake fruit or small squashes extends

the life of the wreath to the whole holiday season. If you want to go

crafty, wrap yarn in holiday colors around a hoop of Styrofoam, tie on

an accent of jingle bells, and create a wreath that lasts for years.

Don't stop there!

Extend the greenery inside! Place wreaths in the

windows and on cabinet doors inside your home where the green will go

great with the wood.

Remember the garland too—match the foliage in your

wreaths to your garland for a put-together look. Creating a garland out

of ribbon instead of pine can give your stairs or fireplace mantel that

extra flair, and you'll avoid the hassle of cleaning up pine needles.

For the stairs, attach wreaths to the railing with wire and loop the

ribbons through it for a drooping curve effect.

If you're still craving nature inside, though,

consider a mini-tree. Spray paint sticks from the yard, plant them in a

vase, and adorn as you desire. Silver ornaments are a dime a dozen, so

pop a bunch on there for easy decoration.

You already know how to decorate the full tree,

but keep in mind its visual appeal. Matching it to other pieces in the

room with colored bows or lights can finish off a room nicely.

Keep the party going at dinner

Wow your guests when they walk in with a few easy

decorations. The tried-and-true way to achieve this is by dressing the

dinner table. Pull out your best dishware and placemats and aim for a

theme. Winter is a great time for silver, or choose plain white plates

with a few accent pieces for pops of color and design. Be sure to use

those pieces for serving food.

Ornaments placed in unusual places create an air

of whimsy. Consider hanging spare ornaments from light fixtures with

ribbons or hooks alongside greenery snipped from your tree. Or pile

everything onto a tiered cake plate to make a nice centerpiece. A tall

houseplant can even serve as a humorous place to put your spare baubles.

Be aware of kids and pets, though!

Centerpieces can make a really big statement while being easy to create. Here are some ideas to get you started:

- Use leftover, oddly shaped wrapping paper to wrap small boxes.

- Mix any of the following in a bowl for that all-encompassing winter feel: fruit, ornaments, pinecones, holiday lights, bells, and candles.

- Place two or three small, elegant bouquets on the table—cups of roses won't bust the budget on flowers.

- If you're down to the last minute, snip some greenery from your Christmas tree, tie it with ribbon at the bottom, and place it in a glass with an inch of water.

Keep your living space nice and clutter-free—edit

after you decorate to be sure you don't overdo it. If you add a wreath,

for example, take away a picture on the wall.

Decorating is easy and simple with a few ideas to

get you started. Small details can generate a lot of buzz when the

relatives start arriving—they'll feel welcomed and in the holiday spirit

already!

Existing home sales are currently at an annual pace of 5.22 million, which is up 1.4% over last month. This reverses the six-month trend of dips in sales every month. The inventory of existing homes is still below the 6-month supply needed for a normal market and is now at a 4.3-month supply. If buyer demand continues to outpace the current supply of existing homes for sale, prices will continue to appreciate.

timgrissett.com

Wednesday, November 21, 2018

Do You Know the Way?

It may be natural for first-time buyers to be unsure of the process of buying a home because they haven't been through it before but even repeat buyers need to know changes that have taken place since the financial housing crisis.

The steps in the home buying process are predictable and generally follow the same pattern. It certainly makes the move stay on schedule when you know all the different things that must be done to get to the closing.

- In the initial interview with your real estate professional, you share the things you want and need in a home, discuss available financing and learn how your agent can represent you in the transaction.

- The pre-approval step is essential for anyone using a mortgage to purchase a home to assure that they're looking at the right price of homes and so they'll know what they can qualify for and what the interest will be.

- Even with lower than normal inventory, it is difficult to stay up-to-date with the homes currently for sale and the new one just coming on the market. Technology has simplified this process, but the buyer needs to implement them.

- Showings can be accommodated online through virtual tours, drive-bys and finally, a personal tour through the home. Your real estate professional can work with you to see all the homes in the market through REALTORS®, builders or for sale by owners.

- When a home has been identified, an offer is written and negotiation over price, condition and terms takes place.

- A contract is a fully negotiated, written agreement.

- Escrow is opened to deposit the earnest money from the buyer as a sign they're acting in good faith. The title search is also started so that clear title can be conveyed from the seller to the buyer and that the lender will have a valid lien on the property.

- 88% of home sales involve a mortgage. The lender will require an appraisal to be sure that the home can serve as partial collateral for the loan. If the buyer has been pre-approved, the verifications will be updated to be certain that they're still valid. The entire loan package when completed, is sent to underwriting for final approval.

- When the contract is completed, at the same time the title search and mortgage approval is being worked on, the buyer will arrange for any inspections that were called for in the contract.

- After all contingencies have been completed, the transaction goes to settlement where all of the necessary papers are signed, and the balance of the buyer's money is paid. This is where title transfers from the seller to the buyer.

- Possession occurs according to the sales contract.

Even if you're not ready to buy or start looking yet, you need to be assembling your team of professionals.

Tuesday, November 20, 2018

Females Are Making It a Priority to Invest in Real Estate!

Everyone wants a place to call home; a place that gives them a sense of security. We are currently seeing major interest from females who want to achieve this dream, and the numbers are proving it!

In 2018, for the second year in a row, single female buyers accounted for 18% of all buyers. In 2017, 60% of millennial women listed as the primary borrowers on mortgages were single.

According to the 2018 Home Buyer and Seller Generational Trends Report by the National Association of Realtors, one in five homebuyers in the U.S. were single females (most of them part of the baby boomer generation) as you can see in the graph below:

This does not come as a surprise since 50.8% of the U.S. population is female and 15.6% of them are 65 years and over, according to the Census Bureau.

What are the reasons for this demographic’s booming interest in homeownership?

Bankrate published an article with what they believe to be some of the reasons:- Divorce rate: Known as the “Gray Divorce,” the divorce rate has doubled for those ages 50 and over and tripled for those ages 65 and over.

- Average life expectancy: For women it’s 81, four years longer than men.

- To build home equity: Women want to build equity through their home. As mentioned by Bankrate, “some are hoping to escape rising rents, some might be downsizing or looking for a new start,” especially those going through a gray divorce.

Are they only downsizing and buying small homes?

Not really; The Institute of Luxury Home Marketing recently stated that:“The number of female billionaires grew faster globally in 2017 than the number of male billionaires. This redistribution of wealth has seen an impact on luxury real estate both in its purchase and design attributes – and obviously, this is important for realtors to recognize when relating to their clients.”

Bottom Line

Whether you are a millennial who wants to buy a starter home, a billionaire looking for that luxury home you’ve always wanted, or maybe even someone who just went through a gray divorce, contact a local real estate professional who can help you create your real estate portfolio and start investing your money in real estate today!

First-time homebuyers are flocking to the real estate market by the thousands to find their dream homes in order to make their dreams of homeownership a reality. Unfortunately for many, the inventory of starter and trade-up homes has struggles to keep up with demand! If you are curious about how much equity you’d earn if you sold your home, contact me for an equity review.

timgrissett.com

Monday, November 19, 2018

7 Reasons to List Your House For Sale This Holiday Season

Every year at this time there are many homeowners who decide to wait

until after the holidays to list their homes for the first time, while

others who already have their homes on the market decide to take them

off until after the holidays.

Here are seven great reasons not to wait:

- Relocation buyers are out there. Many companies are still hiring throughout the holidays and need their new employees in their new positions as soon as possible.

- Purchasers who are looking for homes during the holidays are serious buyers and are ready to buy now.

- You can restrict the showings on your home to the times you want it shown. You will remain in control.

- Homes show better when decorated for the holidays.

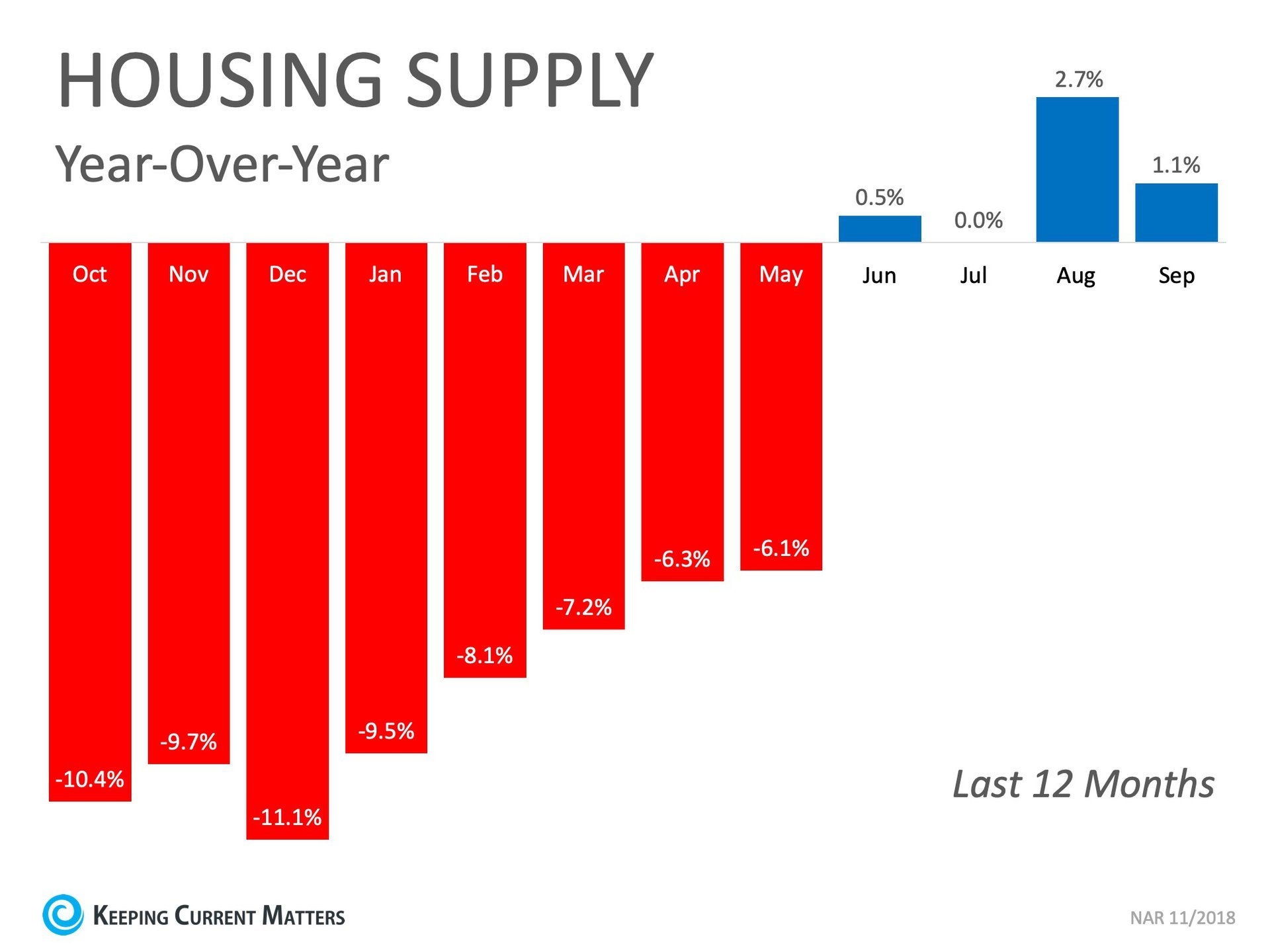

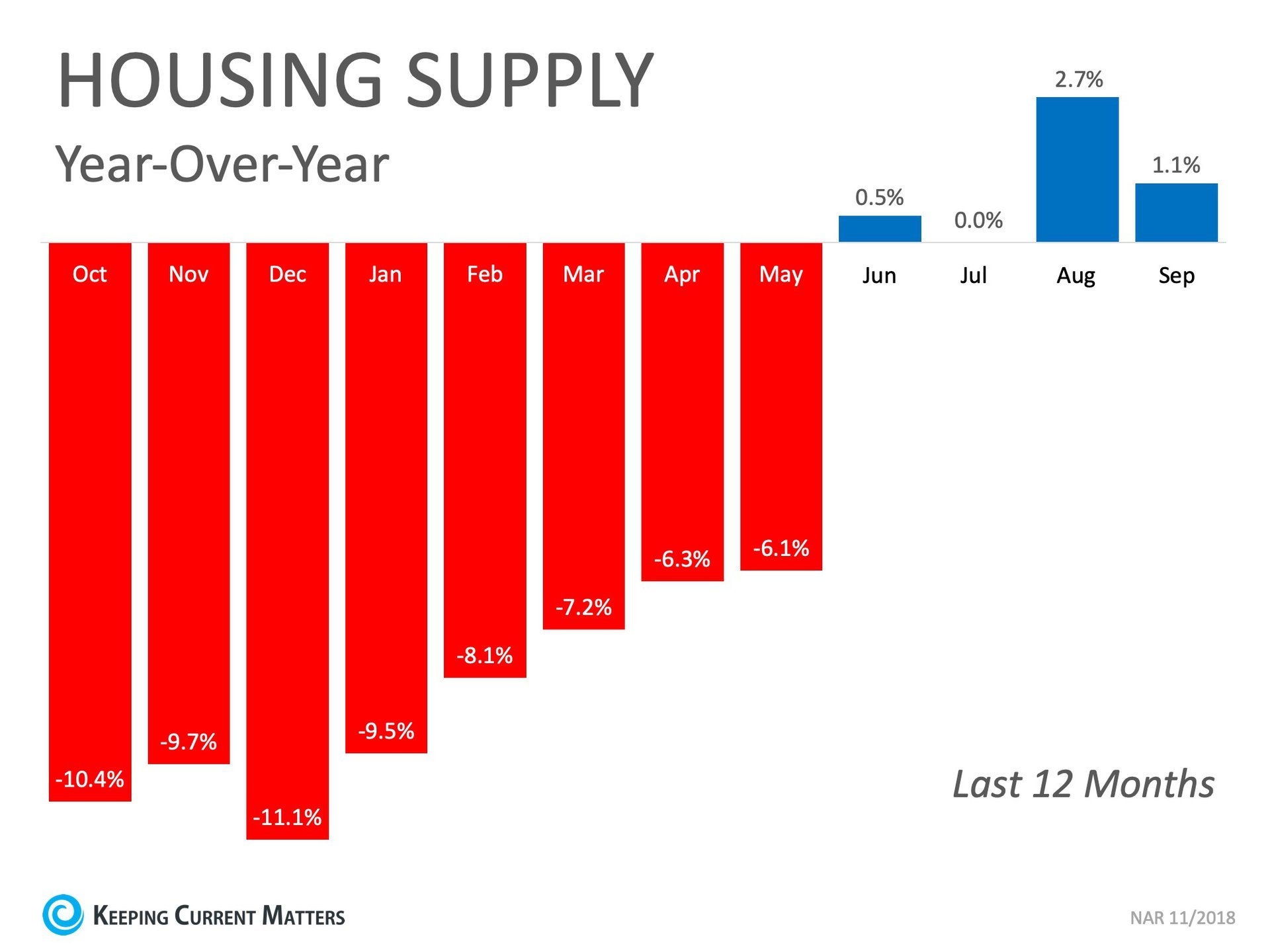

- There is minimal competition for you as a seller right now. Inventory of homes for sale traditionally slows in the late fall, early winter. Let’s take a look at listing inventory as compared to the same time last year:

- The desire to own a home doesn’t stop when the holidays come. Buyers who were unable to find their dream homes during the busy spring and summer months are still searching!

- The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge and reach new heights which will lessen the demand for your house in 2019.

Bottom Line

Waiting until after the holidays to sell your home probably doesn’t make sense.Friday, November 16, 2018

Thursday, November 15, 2018

3 Simple Secrets to Keep Your Home Warm for the Winter

Keeping the Home Fires Burning

There’s nothing like a toasty fire roaring in the fireplace, except maybe for forced air heating that distributes heat evenly throughout the house. Hey, old fashioned fireplaces are romantic, but they’re not the most efficient heat sources out there — that’s why forced air heating was invented and is subsequently the best thing imaginable when there’s snow on the ground.Most of the time, the furnace and blower are the kinds of things people really pay zero attention to. You just set the thermostat and magic heat comes out of the vents magically. You may have never even given a second thought to any sort of maintenance plan for this equipment at all.

While that’s not unusual, you’ll be a lot happier if you adopt one this year.

Getting your furnace ready for the big chill isn’t all that difficult and takes just a little time. All you need to stay warm all winter are these three simple (not so secret) steps:

1. Remember the little things, they matter a lot. Check your furnace filter! Whether it’s just a little dirty or has three inches of dust on it, give it a toss. This is a good time to consider investing in an electrostatic filter that allows you to clean and reuse it again and again. Depending on the size of your furnace filter, they start around $30 and go up from there. An electrostatic filter can be washed often, keeping the air cleaner and making it easier for the furnace to do its thing.

While you’re at it, don’t forget your condensation line. If you just said, “My what?” take a look around the furnace until you find a tube or plastic pipe that goes from it to a pump or drain. That neato little tube tends to accumulate algae and other build-up, until it plugs entirely. Running vinegar through it once a month will help keep it flowing freely and your furnace performing at its best by moving any condensation away from the system. This is especially important if you’re using a heat pump, since it’s essentially an air conditioner with a valve that can go either forward or reverse, depending on your desired results.

Last, check all accessible ducts for air loss. Sure, you like your crawlspace and attic, but maybe not enough to share your heat with them. The tighter your ducts, the more air pressure in your system and the less heat loss you’ll experience. This is by far the most difficult part of basic furnace prep for winter.

2. Call your favorite HVAC professional for a cleaning and inspection. Yes, you cleaned the filter, but there are a lot of parts inside your furnace where dirt and dust collect over the years. If you’ve never had your furnace professionally serviced, now is the time. A pro will look over your air handler and heating elements to ensure they’re safe to use this winter. A cracked heat exchanger is no joke. This is how people die from carbon monoxide poisoning.

While you’re at it, maybe consider asking for a recommendation for a CO detector.

3. Put together your heating backup plan. This goes double if you live somewhere very cold, like Maine. If you live somewhere that’s not really cold at all, like Texas, your plan could be buying a coat. In Maine, or even New Jersey, you’ll want to choose an alternative heating source in case your furnace goes out. Even with a thorough inspection, you could have a small, but important, part go bad, throwing your furnace all out of whack.

Some good options (no, the fireplace sans blower is still a bad option) include infrared heaters or electric oil-filled radiators with safety shut-offs in case they tip. Combustion heaters should never be used indoors without proper ventilation. If you’re planning for a short-term heating solution, just until your furnace is fixed, they can be a lot more trouble than they’re worth. However, if you really want the warmth of wood heat, pellet stoves and catalytic wood stoves can make safe and energy efficient alternatives.

Who You Gonna Call When You Need a Furnace Inspection?

If you don’t already have a favorite HVAC pro, it’s high time you found one. You could ask your neighbors, but why not start with your HomeKeepr community? After all, this group of home pros and homeowners can tell you a lot more about the people they personally recommend (and stake their reputations on) than your neighbor can about the guy that comes by once a year. A quick visit with your network and you’ll have the names of pros you know you can trust to get the job done.Wednesday, November 14, 2018

BAMBOO IT UP

Bamboo has been making its way into home interiors. From flooring, window treatments, and wall accents to furnishings and more, this sustainable material is popping up everywhere.

www.timgrissett.com

#realestate #home #sustainability #flooring

www.timgrissett.com

#realestate #home #sustainability #flooring

Home Sellers in Q3 Netted $61K at Resale

According to a recent report by ATTOM Data Solutions, home sellers who sold their homes in the third quarter of 2018 benefited from rising home prices and netted an average of $61,232.

This is the highest average price gain since the second quarter of 2007 and represents a 32% return on the original purchase prices.

After the Great Recession, many homeowners were left in negative equity situations but home price appreciation in the recovery period since then has given homeowners something to smile about.

The results from ATTOM fall right in line with data from the latest edition of the National Association of Realtors’ (NAR) Profile of Home Buyers and Sellers. Below is a chart that was created using NAR’s data to show the percentage of equity that homeowners earned at the time of sale based on when they purchased their homes.

Even though those who purchased at the peak of the market netted less than those who bought before and after the peak, the good news is that there was a double-digit profit to be had! Many homeowners believe that they are still underwater which has led many of them to not even consider selling their houses.

Bottom Line

If you are curious about how much equity you’d earn if you sold your home, contact a local real estate professional for an equity review. They can help you determine the demand for your home in today’s market and help you develop a plan!Tuesday, November 13, 2018

Monday, November 12, 2018

Friday, November 9, 2018

Thursday, November 8, 2018

Getting the "Right" Home

Finding the right home is still the biggest challenge buyers are faced with in today's market as is shown in the latest Confidence Index Survey. Assuming the buyers find the "right" home with determination, perseverance and the help of a real estate professional, 88% of all transactions last year required financing to get the buyer's address on the home. 93% of first-time buyers needed financing.

Pre-approval is an essential step that needs to be handled before buyers begin searching for a home. The benefits to the buyer fall into the category of confidence.

PRE-APPROVAL GIVES YOU CONFIDENCE

- Knowing the amount you can borrow

the mortgage amount decreases as interest rates rise - Looking at the right priced homes

price, size, amenities, location - Comparing and identifying the best loan

rate, term, type - Uncover issues early that could affect the most favorable loan terms

time to cure possible problems - Bargaining power to negotiate with the seller and possibly, competing buyers

price, terms, & timing - Settlement can occur sooner after contact is accepted

verifications have already been made

- Photo ID

- Two months current pay stubs

- Last two year's W2s

- Complete copies of checking and savings statements for last three months

- Copies of statements for IRAs, 401k, savings, CDs, money market funds, etc.

- Employment history for last two years with addresses and contacts

- Proof of commissioned or bonus income

- Residency history for last two years with addresses and contacts

- Assets for down payment, closing costs, and reserves; must provide paper trail

- If self-employed, last two years tax returns, current profit and loss statement and balance sheet; copy of partnership/corporate tax returns for last two years if owning more than 25% of company

- FHA requires driver's license and social security card

- VA requires original certificate of eligibility and DD214

- Other things may be required such as previous bankruptcy, divorce decree

Wednesday, November 7, 2018

Tuesday, November 6, 2018

5 Tips When Buying a Newly Constructed Home

The lack of existing inventory for sale has forced many homebuyers to begin looking at new construction. When you buy a newly constructed home instead of an existing home, there are many extra steps that must take place.

To ensure a hassle-free process, here are 5 tips to keep in mind if you are considering new construction:

1. Hire an Inspector

Despite the fact that builders must comply with town and city regulations, a home inspector will have your best interests in mind! When buying new construction, you will have between 1-3 inspections, depending on your preference (the foundation inspection, the pre-drywall inspection, and a final inspection).These inspections are important because the inspector will often notice something that the builder missed. If possible, attend the inspection so that you can ask questions about your new home and make sure the builder fixes any problems found by the inspector.

2. Maintain good communication with your builder

Starting with the pre-construction meeting (where you will go over all the details of your home with your project manager), establish a line of communication. For example, will the builder email you every Friday with progress updates? If you are an out-of-state buyer, will you receive weekly pictures of the progress via email? Can you call the builder and if so, how often? How often can you visit the site?3. Look for builder’s incentives

The good thing about buying a new home is that you can add the countertop you need, the mudroom you want, or an extra porch off the back of your home! However, there is always a price for such additions, and they add up quickly!Some builders offer incentives that can help reduce the amount you spend on your home. Do your homework and see what sort of incentives the builders in your area are offering.

4. Schedule extra time into the process

There are many things that can impact the progress on your home. One of these things is the weather, especially if you are building in the fall and winter. Rain can delay the pouring of a foundation as well as other necessary steps at the beginning of construction, while snow can freeze pipes and slow your timeline.Most builders already have a one-to-two-week buffer added into their timelines, but if you are also in the process of selling your current home, you must keep that in mind! Nobody wants to be between homes for a couple of weeks.

5. Visit the site often

As we mentioned earlier, be sure to schedule time with your project manager at least once a week to see the progress on your home. It’s easy for someone who is not there all the time to notice little details that the builder may have forgotten or overlooked. Additionally, don’t forget to take pictures! You might need them later to see exactly where that pipe is or where those electrical connections are once they’re covered up with drywall!Bottom Line

Watching your home come to life is a wonderful experience that can sometimes come with hassles. To avoid some of these headaches, keep these tips in mind!If you are ready to put your current home up for sale and find out what new construction is available in your area, call a local real estate agent who can help you with the sale of your current home and the search for your new one.

Monday, November 5, 2018

2 Myths Holding Back Home Buyers

Urban Institute recently released a report entitled, “Barriers to Accessing Homeownership: Down Payment, Credit, and Affordability,” which revealed that,

“Consumers often think they need to put more money down to purchase a home than is actually required. In a 2017 survey, 68% of renters cited saving for a down payment as an obstacle to homeownership. Thirty-nine percent of renters believe that more than 20% is needed for a down payment and many renters are unaware of low–down payment programs.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the down payment funds needed to qualify for a home loan. According to the same report:“Most potential homebuyers are largely unaware that there are low-down payment and no-down payment assistance programs available at the local, state, and federal levels to help eligible borrowers secure an affordable down payment.”These numbers do not differ much between non-owners and homeowners. For example, “30% of homeowners and 39% of renters believe that you need more than 20 percent for a down payment.”

While many believe that they need at least 20% down to buy their dream homes, they do not realize that there are programs available which allow them to put down as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined with programs that have emerged allowing less cash out of pocket.

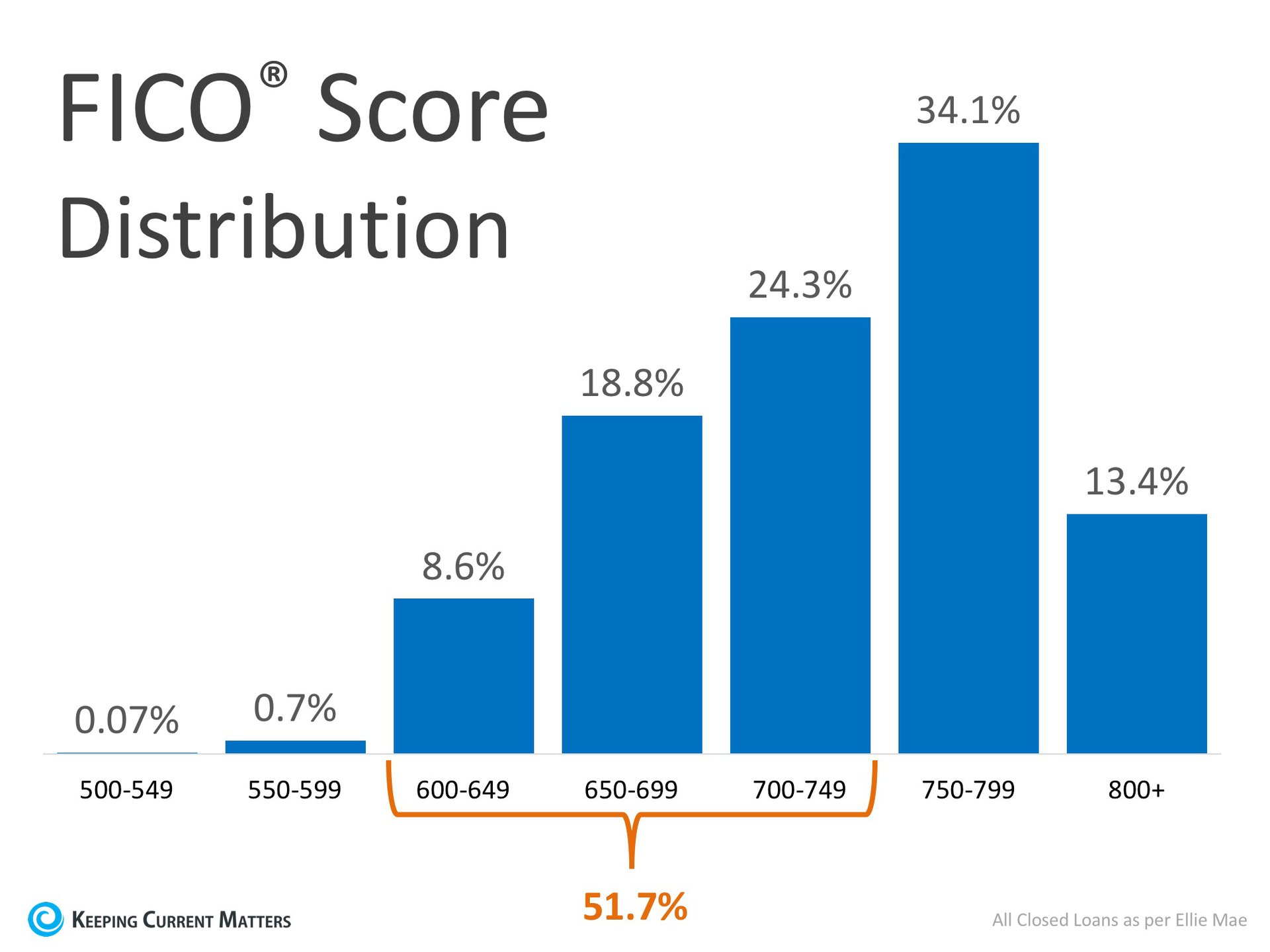

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Similar to the down payment, many either don’t know or are misinformed about what FICO® score is necessary to qualify.Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans.

As you can see in the chart above, 51.7% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.Friday, November 2, 2018

Subscribe to:

Comments (Atom)