Monday, July 31, 2017

2007 vs 2017

In 2007, there was speculative investing, loose lending, new construction abundance and now in 2017 there is consumer demand, low inventory, job growth, population growth, and controlled lending. Inventory is down across the state, supply is low and demand is high. The time to sell is now, contact me to take advantage of a healthy housing market!

Friday, July 28, 2017

Inventory Drops Again, Sales Slow

Highlights: Existing Home Sales are now at an annual pace of 5.52 million. Inventory of existing homes for sale dropped to a 4.3-month supply, marking the 25th month in a row of declines. The median price of homes sold in June was $263,800. This is the 64th consecutive month of year-over-year price gains.

Thursday, July 27, 2017

A tight supply of houses for sale, along with rising prices and worries about higher mortgage rates, is making buying a home a challenge in some areas this season. All that means that competition is fierce in some markets, especially for lower- and mid-priced homes, and home shoppers must be nimble.

Americans Still Believe Real Estate is Best Long-Term Investment

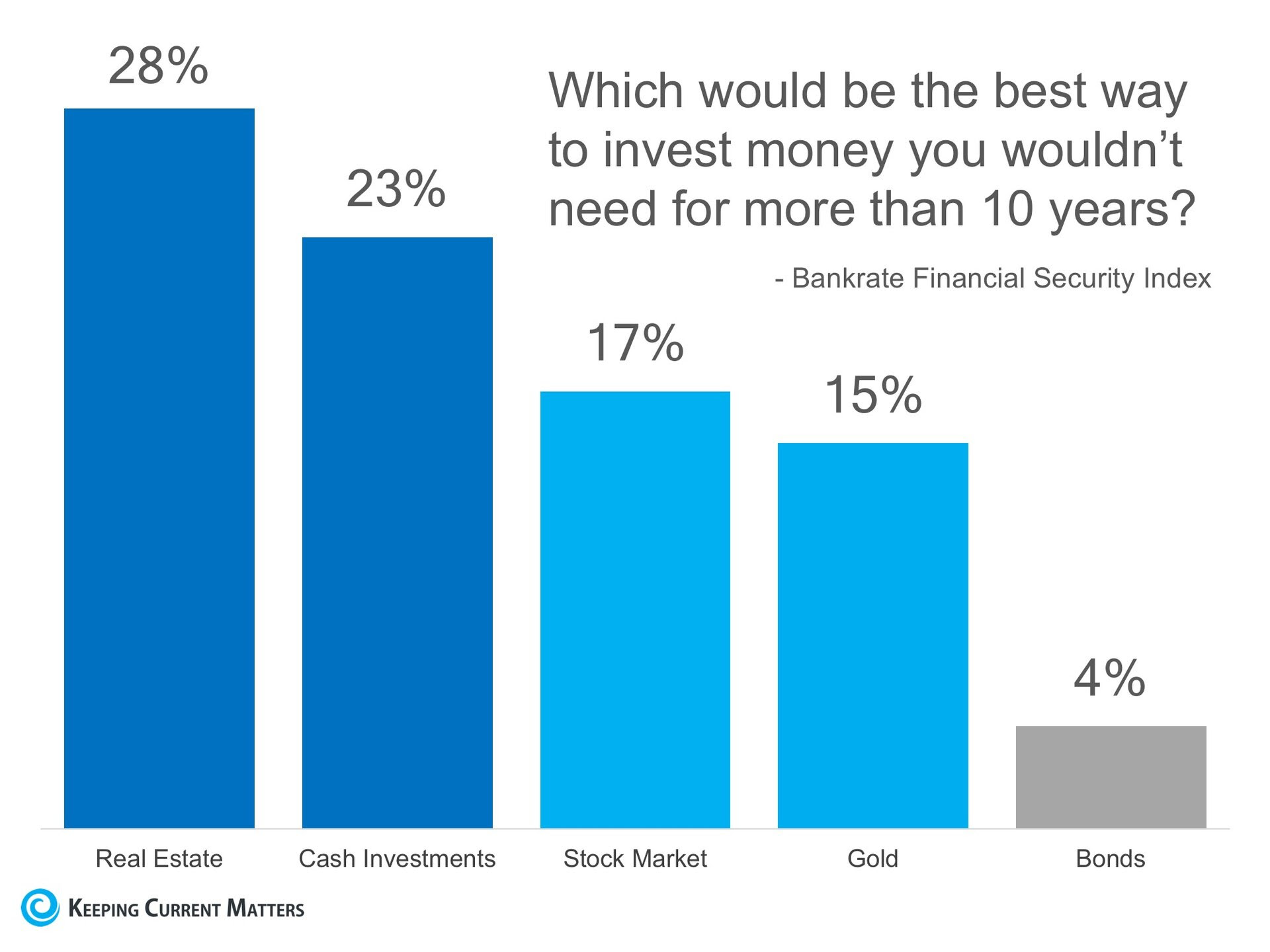

Bankrate asked Americans to answer the following question:

“What is the best way to invest money you wouldn’t need for 10 years or more?”Real Estate came in as the top choice with 28% of all respondents (3% higher than last year), while cash investments – such as savings accounts and CD’s – came in second with 23% (the same as last year). The chart below shows the full results:

The article points out several reasons for these results:

“After bottoming out at the end of 2011 following the worst housing collapse in generations, home prices have gone gangbusters recently, climbing back above their record pre-crisis levels. Prices jumped 6.6 percent during the 12 months that ended in May, according to CoreLogic.The article also revealed that:

Toss in persistently low interest rates, tax goodies that come with owning a mortgage, and the psychological payoff from planting your roots, and maybe it’s no wonder real estate remains popular.”

“Bankrate’s Financial Security Index — based on survey questions about how people feel about their debt, savings, net worth, job security and overall financial situation — has hit its third-highest level since the poll’s inception in December 2010.”

Bottom Line

We have often written about the financial and non-financial reasons homeownership makes sense. It is nice to see that Americans still believe in homeownership as the best investment.

Wednesday, July 26, 2017

Tuesday, July 25, 2017

Monday, July 24, 2017

Friday, July 21, 2017

Thursday, July 20, 2017

Wednesday, July 19, 2017

The Ten Commandments of Selling A Home

So your home’s on the market — are you jazzed about getting it sold? Good. But there are a few things you need to know. More specifically, ten things. They’re called “The Ten Commandments of Selling a Home.”

Read them. Absorb them. Emblazon them to memory, because one tiny mis-step can make your dream of moving on to your next home come crashing down like a sandcastle at high tide.

Tuesday, July 18, 2017

The Business of Flipping Homes

On the rebound from recession, the real-estate market is hot right now,

and there's no better time to buy and flip investment properties. But

before you get started, you need to know the right way to flip. There is

more to flipping than redoing a kitchen or staging a property. Every

deal is different, and each investor must have a clear business

strategy. Take one and call me in the morning. timgrissett.com

Monday, July 17, 2017

Friday, July 14, 2017

Summer is for Outdoor Living

If you’re looking for a refreshing, secluded retreat – look no further than your own home!

A courtyard is a homeowner’s outdoor oasis—a charming, open space free of indoor heat and stuffiness and the craziness of everyday life. Whether you throw parties every weekend and aspire to impress every guest, or just want to indulge in the cool, crisp air of autumn evenings in the privacy and security of your own home, few things compare to the glory of having a house with an outdoor living space.

A courtyard is a homeowner’s outdoor oasis—a charming, open space free of indoor heat and stuffiness and the craziness of everyday life. Whether you throw parties every weekend and aspire to impress every guest, or just want to indulge in the cool, crisp air of autumn evenings in the privacy and security of your own home, few things compare to the glory of having a house with an outdoor living space.

Thursday, July 13, 2017

Wednesday, July 12, 2017

Tuesday, July 11, 2017

Selling Your Home And The Buyer Cancels

They're Not Buying Our Home? Why?Telling a seller that the buyers changed their mind is something Realtors hate.

Luckily, it doesn't happen often. When it does it's usually within the first couple of weeks of the contract but not always.

It's important for sellers to understand that cancellations can and do happen. It's easy for buyers to have a change of heart. They may find another home they like better. Maybe they wake up with a bad case of buyer's remorse after signing the contract. Or maybe they decide they can't afford it.In recent years, buyers were bad to cancel their contracts on short sales. They would make an offer. Then months would drag by while everyone waited for bank approval.

Buyers grew impatient. Sometimes they continued looking at other homes and found a home they liked better. Buyers can and do cancel their offers on traditional sales. The standard agreement requires buyers to make an "Earnest Money Deposit".

This deposit is the seller's best insurance that the buyer is serious. The buyer usually states that they will make the Earnest Money Deposit within a couple of business days. If the buyer fails to make the Earnest Money Deposit within the agreed upon time frame, the buyer is breeching the agreement.

Stalling or not making the Earnest Money Deposit is a tactic we see when buyers are making multiple offers. In a market with low inventory, buyers may find two or three homes that suit their needs. They'll make offers on each one to see who will meet their price. When they've heard back from all the offers, they'll pick their favorite. This is frustrating for sellers but it's better that a buyer cancel before escrow is opened than waste weeks of a seller's time. Once the Earnest Money is in the escrow account, the buyer is only entitled to a refund if they cancel due to contingencies in their offer. As Bankrate reported, there are eight contingencies that often allow buyers an out. As a seller, it's important that you and your agent are aware of the contingencies in any offer.

A top listing agent will not only be aware of the contingencies, they will track whether the buyer is doing them on schedule. Most contracts provide buyers a 10 day "due diligence" period. During the due diligence, the buyer gets access to the home for inspections and certifications. The seller must provide the Seller's Real Property Disclosures during this time.

Inspection issues can terminate the agreement. If the inspector finds problems, the buyer and seller may agree on repairs. In lieu of repairs, the seller may contribute funds to cover the cost of repairs. When the buyer and seller can't agree on the repairs, they can cancel the deal. This is a good reason for sellers to consider having their home inspected before listing it for sale. This is an added expense that many home sellers prefer to avoid, especially if the home is newer and well maintained. We've seen situations where an inspection uncovered something the seller's were completely unaware of.

In one situation, the sellers were moving out of Las Vegas due to the wife's health issues. When our buyers had the home inspected, they found a serious mold issue with the HVAC system. The sellers had to have mold remediation and a new HVAC system. The ducts for the eleven thousand square foot home had to be professionally cleaned. Our buyers didn't walk away when they heard the "M" word. Some buyers do. Who knows if the mold contributed to the seller's health issues?

Sellers who choose to skip hiring their own inspector should take a look at the home themselves. You can prepare for the home inspection by changing the AC filters, any dead batteries in smoke detectors, etc. Those are minor, but two of the most common items our inspectors find.

Is the home is in a homeowner's association? Sellers must provide the buyers with a copy of the most recent Common Interest Community (HOA) documents. Your agent will typically order them and you will pay for them. You will want to order them once the earnest money is in escrow. The HOA may take up to 10 days to provide the documents. Once the buyer receives the documents, they have five days to review them. If they find anything objectionable they can cancel the agreement without risking their EMD.

Financing is another contingency that causes problems in today's market. Sellers should work with an agent who will double check the buyer's pre-approval letters. In some cases, they may ask the buyer to get approved with a lender they trust. The buyer is free to use the lender of their choice, but sellers have the option of verifying the buyer's ability to qualify.

A common mistake sellers make is to assume that buyers offering a low down payment are not as qualified as those offering a bigger down payment. Today's low interest rates encourage many buyers to finance as much as possible. The buyer using a VA or FHA loan may have stellar credit. Your Realtor should vet their approval letters, including calling their lender before you accept an offer with financing.Part of the financing will be the appraisal contingency. Banks are stricter about the loans they make than when you bought your home a few years ago. Upgrades may not be valued as high as you would expect. If the appraisal comes in lower than the purchase price, the buyer may ask you to sell for the appraised value. If the buyer agrees your home is worth more than the appraised value, they may pay some or all the difference out of their own funds. If you can't work something out, they may cancel the agreement and receive a refund. One of the best ways to avoid appraisal issues is to price the home in line with the current market.

Does the buyer need to sell their current home first? Going into contract with a buyer who has to sell their home first is risky business. Too many things can go haywire with the home they're selling. Before considering the offer, your agent should verify that their home is listed. They should check to see that it's "priced to sell". Have them question the buyer's agent about activity on the home. It would be best if the buyer's home was already in contract and their buyer's due diligence period had passed. Accepting an offer that's contingent on the sale of another home is a gamble to avoid if possible.

So what happens if you pass all contingency deadlines and the buyer still cancels? They may not be entitled to a refund of the EMD. In case of a dispute, most contracts call for mediation.

When making the offer, the buyer will choose one of two options. One reads "Seller may retain, as liquidated damages, the EMD". The second reads, "Seller shall have the right to recover from Buyer all of Seller's actual damages".

Most buyers will pick the first option rather than risk having a seller pursue an amount higher than the EMD. The EMD is likely to be the only compensation for a seller when a buyer cancels without cause.Yes, You Can Still Get Your Home SoldNow that the buyer has defaulted, how do we get my home sold? When a buyer cancels the deal it can create a stigma. Future buyers will want to know what went wrong. Were there inspection issues? Did the home appraise? It's best to give honest answers to those questions. If the cause was a problem uncovered during the inspection, you need to make any necessary repairs. Save all receipts to show future buyers.

Appraisal issues can be more complicated. Your agent needs to show comps, a list of upgrades, etc., as evidence that the appraiser made a mistake. And, if the buyer just flaked out, your agent can disclose that.

You should put the home back on the market as soon as possible. You may want to revisit your list price before you do. Have your Realtor check to see if any homes have sold that will influence your appraisal. Are there new listings to compete with your home? If a price adjustment is warranted, better to do it sooner than later.

Do you have to move out before the Close of Escrow? Under most circumstances, yes. Buyers are entitled to do a final walk through before closing escrow on your home. You need to move out and allow enough time to clean, sweep and get rid of trash after moving out. The final walk through is the buyer's last chance to cancel for cause. It's important that sellers maintain their home while it's in escrow. If anything gets damaged or breaks after the inspection, get it fixed.

If the buyer agrees, you can ask to do a "leaseback" when negotiating their offer. Most buyers will need to be moved into the home by a certain date. That may prevent them from agreeing to a leaseback. If they can accomodate the leaseback they will expect you to leave some funds in escrow after closing. This will serve as a security deposit to cover any damages that might occur. They will still want to do a final walk through before closing. The final walk thru will provide a checklist when they inspect the home after you've moved. Any damages that occur during the leaseback will be withheld from the funds you've left in escrow.

Selling a home includes a lot of moving parts. That's why Realtors preach that you need to declutter, make repairs and price it right. You have the best chance of selling your home without issues if you take all the right steps. This includes hiring a top Realtor in your specific area.

Monday, July 10, 2017

8 Ways to Make Your Backyard a Summer Paradise

Summer is the season to be outdoors. It’s the perfect time for backyard barbecues, neighborhood socials, and late-night evenings on the patio. You don’t need to travel to a luxurious and exotic location to enjoy spending time outdoors. Make your own backyard a summer paradise with these eight simple suggestions.

Inspect and update wooden decks

To make your backyard a summer haven, take some time to inspect and update your deck. Wooden patios and decks can be warped by cold weather, so you’ll want to replace loose or missing slats as needed. Sand, stain, and seal your deck once you’ve made sure it’s structurally sound. If you have a stone patio, check for missing pieces and update as needed. Once this is complete, you’ll have a shiny and appealing deck you can decorate with patio furniture—creating a relaxing sitting area for summertime.

Purchase patio furniture and essentials

Once you have a designated patio or deck space, you’ll want to add some patio furniture so you can sit down, mingle with friends and family, and relax. Consider purchasing weatherproof patio furniture that is both comfortable and durable. Patio furniture can be exposed to harsh, seasonal weather, so you’ll want to make sure it lasts for years.

Get the basics including some lounge chairs, an umbrella, a hammock, and an outdoor table so you can enjoy meals or games outside. In addition to patio furniture, you may want to buy or build an outdoor fire pit. It’s a simple feature that adds so much to your backyard. Sit around the fire and socialize, roast marshmallows or even cook dinner on your own backyard fire place.

Add colorful cushions and pillows

You’ll want to add a splash of color to your patio so it’s eye-catching and sings of summertime. Buy some bright-colored, and comfortable throw pillows and cushions to spice up the furniture. The bright colors and fun patterns will entice people to sit down, relax, and enjoy your backyard paradise.

Get a rug for the patio

Consider adding a rug to the patio or deck area to make the space feel cozier. Outdoor rugs vary in material, size, and shape and are generally made to last in all types of weather. They make a great addition to your space, and can also protect your deck.

Install outdoor lighting

Nothing is more magical than twinkling lights against a royal-blue evening sky. Add strands of tea lights or other innovative lights to create a fairy-tale effect in your backyard. In addition to the decorative lighting, you’ll want to consider adding sensor or smart lights to your backyard for added security. Smart lights are a great way to ensure the backyard is lit—you can even control smart lights with your smart phone.

Make the backyard private

You may love your neighbors, but that doesn’t mean you want them always peeking into your backyard. Be creative when thinking of ways to ensure better backyard privacy. One easy way to create a private, secluded backyard paradise is to install a fence. Not only does it ensure privacy, but it is an essential safety measure. Install a strong, secure fence to create a private and safe backyard.

Update your landscaping

Landscaping can make or break your backyard. It’s essential to take time to update your landscaping to create an outdoor paradise. You don’t need extravagant plants or trees to make your backyard grand. Take some time to cut back unruly trees and bushes, pull the weeds, water and trim the lawn, and plant flowers around the yard. These simple updates will make a world of difference. You’ll have your own secret garden in no time!

Secure outdoor belongings

Once you’ve created a magical backyard space, you’ll want to take the necessary precautions to safeguard your belongings. Make sure your garden tools and supplies are in a locked shed—away from kids, pets, and burglars. Take time to assess the backyard for any security breaches. This will keep your family safe and protect your backyard, patio, and deck from major damages.

Summer is a wonderful time to relax and enjoy being outdoors. Update your own backyard and you’ll have access to a private paradise any time you want.

Friday, July 7, 2017

Buying a Short Sale: Tips and Tricks for the Discerning Buyer

Looking to buy a property that is selling short could be a great way to get a better price on a home that you might not otherwise be able to afford. You should be prepared for a more complicated process, however. Here’s what you need to know.

Why Are Short Sales More Difficult?

A short sale means that the seller is offering the home at a lower price than what they owe on the mortgage. This makes that once the sale is complete and the real estate agent has been paid, there will be less to pay off the mortgage lender or lenders than the total amount of the mortgage. It complicates the process because the lender has to give approval for the sale price before the seller and buyer can close on the sale. In some cases, there may be more than one lender involved, and they all have to agree.

Prepare for a Longer Buying Process

The more interested parties you involve in a home sale, the longer it takes and the more likely it is to fail. Home sales can fall through for a number of reasons, but short sales are more likely to fail because one or more of the lenders did not accept the buyer's offer. If you are looking specifically to buy short sales, you should be ready for a longer buying process. You may have to make offers on a larger number of properties before you find one with a lender that is ready to work with you. If you have mortgage pre-approval and locked in an interest rate for a short term, you might consider casting a wider net at first so that you have a better chance of concluding the sale before the time runs out.

Get Your Situation in Order

Although many lenders take a longer time to grant approval, sometimes you happen across a property with a seller and lender that are more than ready to conclude the process. In this case, you might be able to land a fantastic price, but you must be prepared to move quickly. If you find a sale that expects to close in weeks or days, make sure that you can accommodate that before you make an offer.

Negotiate With the Seller

When you engage in a typical home sale, you mostly have to work with the seller and your own lender. With a short sale, the seller has fewer options to negotiate with you. This is especially true if the seller is a friend or relative of yours. You are free to set a number of contingencies, but bear in mind that the seller must obtain lender approval for all of them, especially those that expect the seller to shoulder additional expenses.

Wait for Lender Approval

Since each lender has to sign on the offer before the sale can proceed, each step in the process could take longer. However, you are not simply bound by the whims of each lender. In your purchase contract, specify the amount of time you are willing to wait for a lender’s answer at each point of approval. This way, you have the ability to walk away from the sale if it seems that the lender is taking far too long to make a decision.

Buying a short sale could be a great deal, but it is often a bigger hassle. With these tips, you will know what to expect and can plan accordingly.

3 Types of Mortgage Options

Just as homes come in different styles and price ranges, so do the ways you can finance them.

While it may be easy to tell if you prefer a rambler to a split-level or a craftsman to a colonial, figuring out what kind of mortgage works best for you requires a little more research. There are many different loan types to choose from, and a great lender can walk you through all of your options, but you can start by understanding these three main categories.

Thursday, July 6, 2017

Wednesday, July 5, 2017

How to Get the Home You Want

How to Get the Home You Want: Get Ready! Talk to your mortgage professional about your financial situation and credit history to determine your loan options.

It’s important to know how much house you can afford based on your down payment and income. A strong letter of pre-approval can really add to your bargaining power.

Your Opportunity to Achieve the American Dream Keeps Getting Better!

Forbes.com recently released the latest results of their American Dream Index, in which they measure “the prosperity of the middle class, and…examine which states best support the American Dream.”

The monthly index measures several different economic factors, including goods-producing employment, personal and commercial bankruptcies, building permits, startup activity, unemployment insurance claims, labor force participation, and layoffs.

The national index score was rounded out to 100.0 in January as a baseline for comparison and it rose the fourth straight month in a row to 101.8.

Forbes Senior Editor Kurt Badenhausen explained why many states saw a boost in the index last month:

“The American Dream Index rose for the fourth straight month to 101.8 propelled by gains in goods-producing jobs and building permits, as well as declines in unemployment claims and mass layoffs.

Goods-producing jobs (manufacturing, mining, construction and agriculture) were up for the ninth straight month in May…Building permits rose for the fourth straight month compared to the prior year.”

Bottom Line

The American Dream, for many, includes being able to own a home of one’s own. With the economy improving in many areas of the country, that dream can finally become a reality.

Monday, July 3, 2017

Tips to Renovate On A Budget

Renovation projects can get expensive; however, it is possible to stay on budget. Whether you’re updating your space or completing a total makeover, the information below features several tips to help stay on budget for your next project.

Navigating the Real Estate Transaction

The process of buying or selling a home can be overwhelming for many people. Below are five tips to help you prepare for and get through a real estate transaction. If you’re thinking of entering the market this year, remember to give me a call. I’d love to chat with you about our local market.

Subscribe to:

Comments (Atom)