Thursday, February 28, 2019

Wednesday, February 27, 2019

Depends If You Can Afford It

Affordability, stability and flexibility are the three reasons homebuyers overwhelmingly choose a 30-year term. The payments are lower, easier to qualify for the mortgage and they can always make additional principal contributions.

However, for those who can afford a higher payment and commit to the 15-year term, there are three additional reasons: lower mortgage interest rate, build equity faster and retire the debt sooner.

The 30-year, fixed-rate mortgage is the loan of choice for first-time buyers who are more likely to use a minimum down payment and are concerned with affordable payments. For a more experienced buyer who doesn't mind and can qualify making larger payments, there are some advantages.

Consider a $200,000 mortgage at 30 year and 15-year terms with recent mortgage rates at 4.2% and 3.31% respectively. The payment is $433.15 less on the 30-year term but the interest being charged is higher. The total interest paid by the borrower if each of the loans was retired would be almost three times more for the 30-year term.

Let's look at a $300,000 mortgage with 4.41% being quoted on the 30-year and 3.84% on the 15-year. The property taxes and insurance would be the same on either loan. The interest rate is a little over a half a percent lower on the 15-year loan, but it also has a $691.03 higher principal and interest payment due to the shorter term.

The principal contribution on the first payment of the 30-year loan is $401.56 and it is $1,235.09 on the 15-year loan. The mortgage is being reduced by $833.53 more which exceeds the increased payment on the 15-year by $142.50. Interestingly, over three times more is being paid toward the principal.

Some people might suggest getting a 30-year loan and then, making the payments as if they were on a 15-year loan. That would certainly accelerate amortization and save interest. The real challenge is the discipline to make the payments on a consistent basis if you don't have to. Many experts cite that one of the benefits of homeownership is a forced savings that occurs due to the amortization that is not necessarily done by renters.

Use this 30-year vs. 15-year financial app to compare mortgages in your price range. A 15-year mortgage will be approximately half a percent cheaper in rate. You can also check current rates at FreddieMac.com.

Tuesday, February 26, 2019

Monday, February 25, 2019

How Can I Increase My Family's Net Worth?

Every three years, the Federal Reserve conducts their Survey of Consumer Finances. Data is collected across all economic and social groups. The latest survey data covers 2013-2016.

The study revealed that the median net worth of a homeowner is $231,400 – a 15% increase since 2013. At the same time, the median net worth of renters decreased by 5% ($5,200 today compared to $5,500 in 2013).

These numbers reveal that the net worth of a homeowner is over 44 times greater than that of a renter.

Owning a home is a great way to build family wealth.

As we’ve said before, simply put, homeownership is a form of ‘forced savings.’ Every time you pay your mortgage, you are contributing to your net worth by increasing the equity in your home.That is why Gallup reported that Americans picked real estate as the best long-term investment for the fifth year in a row. According to this year’s results, 34% of Americans chose real estate. Stocks followed at 26%, and then gold, savings accounts/CDs, or bonds.

Bottom Line

If you want to find out how you can use your monthly housing cost to increase your family’s wealth, meet with a real estate professional in your area who can guide you through the process.Friday, February 22, 2019

Thursday, February 21, 2019

Wednesday, February 20, 2019

Do You Know the Way?

Fear of the unknown is common among all ages. Kids, at night, imagine monsters in their closets or under their beds and adults are unsure of what the future might bring.

It may be natural for first-time buyers to be unsure of the process because they haven't been through it before but even repeat buyers need to know changes that have taken place since the financial housing crisis.

The steps in the home buying process are very predictable and generally follow the same pattern every time. It certainly makes the move stay on schedule when you know all the different things that must be done to get to the closing.

- In the initial interview with your real estate professional, you share the things you want and need in a home, discuss available financing and learn how your agent can represent you in the transaction.

- The pre-approval step is essential for anyone using a mortgage to purchase a home to assure that they're looking at the right price of homes and so they'll know what they can qualify for and what the interest will be.

- Even with lower than normal inventory, it is difficult to stay up-to-date with the homes currently for sale and the new one just coming on the market. Technology has simplified this process, but the buyer needs to implement them.

- Showings can be accommodated online through virtual tours, drive-bys and finally, a personal tour through the home. Your real estate professional can work with you to see all the homes in the market through REALTORS®, builders or for sale by owners.

- When a home has been identified, an offer is written and negotiation over price, condition and terms takes place.

- A contract is a fully negotiated, written agreement.

- Escrow is opened to deposit the earnest money from the buyer as a sign they're acting in good faith. The title search is also started so that clear title can be conveyed from the seller to the buyer and that the lender will have a valid lien on the property.

- 88% of home sales involve a mortgage. The lender will require an appraisal to be sure that the home can serve as partial collateral for the loan. If the buyer has been pre-approved, the verifications will be updated to be certain that they're still valid. The entire loan package when completed, is sent to underwriting for final approval.

- When the contract is completed, at the same time the title search and mortgage approval are being worked on, the buyer will arrange for any inspections that were called for in the contract.

- After all contingencies have been completed, the transaction goes to settlement where all the necessary papers are signed, and the balance of the buyer's money is paid. This is where title transfers from the seller to the buyer.

- Possession occurs according to the sales contract.

Even if you're not ready to buy or start looking yet, you need to be assembling your team of professionals. Let us know and we'll send you our recommendations, so you can read about them on their websites.

Tuesday, February 19, 2019

House Staging Tips For Beginners

There’s a reason that staging companies exist – the process can be really hard work! However, it exists as one of the key ways you can help buyers envision themselves in your home and sell it fast! If you can’t afford a staging professional or if you want to try your hand at it first, you’re in luck!

1. Detach yourself from your home.

Staging takes the focus of your home away from you and puts it on the potential new owners; detaching yourself makes it easier to remove clutter and personal effects without getting too emotional. Staged versus unstaged rooms look completely different. If you have any questions, ask your realtor to show you some before and after photos so you too can see the effective change!

2. Decorate minimally.

Always clear out clutter and other personal items that can distract buyers: picture collages, hand-drawn artwork, calendars, etc. You aren’t selling your personal life, so don’t stage the house with it. Be sure to furnish the space to show off how functional it is; keep furniture light-colored and minimal to show how much space the potential buyer can get with their purchase. When buyers come through and can imagine themselves living there, you can bet an offer isn’t far behind!

3. Focus on the front.

Curb appeal is vitally important to your sale. This is a great way to attract buyers to your MLS listing even before a Realtor contacts his or her buyer. When a potential buyer drives by or even first arrives, you want them to immediately feel pleased with their decision to consider purchasing your home. You can hire a landscaper to clean up the front, or check out some DIY landscape designs on our Pinterest.

4. Deep clean your bathrooms.

One of the major things to throw off potential buyers is a grimy shower door or dirty bathroom walls. Because of this known fact, many sellers think there is a need to replace items used on a daily basis, but that is simply not true! You just need to be sure to find some tried and true cleaning techniques to get your house looking brand new. Or, consider hiring a cleaning company to do a “move out” clean. It costs a little more than hiring someone to clean on a consistent schedule but is a worthwhile investment in the event your home sells quicker than expected.

5. Decorate to appeal to both sexes.

It’s easy to allow your decorating bias to kick in and go to town on your personal bias, female or male, but try to keep things neutral. You want to make sure that either sex can appreciate the space and imagine themselves in it.

6. Stage rooms with an obvious purpose.

Potential buyers can feel confused by extra rooms that seem to have a multitude of uses. Clear away clutter and excess furniture, paint the walls a neutral tone and then furnish the room with a desk to stage it as a home office or fill it with book shelves and a comfortable chair to help them envision a reading room.

7. New kitchen appliances really ARE worth it to buyers.

No matter what your personal taste, the majority of buyers love stainless steel appliances. They help create a clean, crisp version of your kitchen that anyone would love to call their own. Be sure to minimize the decor and clutter in your kitchen, too; this is the space that most sells homes.

8. Don’t be afraid to maximize your light!

Aside from keeping the shades or curtains open, it helps to keep many (if not all) lights on in your home when it’s shown, light a fire in the fireplace, or even purchase a few candles! Light colored walls and furniture also help to brighten things up. Light creates a pleasant flow between rooms and is a way to naturally show off your home’s best features.

9. Unpleasant odors have got to go.

We all love our pets, bet they do create a certain smell in carpeted areas. Either have your carpet professional cleaned, replaced, or completely removed and hardwoods refinished before showing. Taking care of this before a potential buyer requests it is a great way to increase your offers and can help you to avoid unexpected expenses during the selling process.

10. Don’t ignore the outside.

I know we’ve already mentioned focusing on the front, but don’t ignore the back of your home, either! Make sure you power wash or repaint the exterior of your home. Also, take note of any decks, sidewalks, garage floors, and driveways that need a good power wash. Anyone who has owned a home knows how much work it takes to fix up an outdoor space; a move-in-ready exterior is an added bonus that many buyers will appreciate!

Monday, February 18, 2019

Millionaire To Millennials: Don’t Get Stuck Renting A Home… Buy One!

In a CNBC article, self-made millionaire David Bach explained that: “The biggest mistake millennials are making is not buying their first home.” He goes on to say that, “If you want to build real financial security, real wealth for your lifetime, then you need to buy a home.”

Bach went on to explain:

“Homeowners are worth 40 times more than renters. Now, that first home doesn’t need to be a dream home, it can be a very small home. You might literally have to buy a small studio apartment, but that’s how you get started.”Then he explains the secret to buying that home!

“Don’t do a 30-year mortgage. You want to take that 30-year mortgage and instead pay it off early, do a 15-year mortgage. What happens if you do a 15-year mortgage? Well, one, you pay the mortgage off 15-years sooner, that means you’ll be able to retire in your fifties. Number two, you’ll save a fortune (on potentially hundreds of thousands of dollars in interest payments).”What will it cost to pay your mortgage in fifteen years? He explains further:

“For fifteen years, you got to brownbag your lunch. Think about that! Brownbag your lunch literally for fifteen years. You can retire ten years sooner than your friends. You’ll have real wealth, because you bought a home – you’re not a renter. And you’ll be financially secure for life.”

Bottom Line

Whenever a well-respected millionaire gives investment advice, people usually clamor to hear it. This millionaire gave simple advice – if you don’t yet live in your own home, go buy one.Who is David Bach?

Bach is a self-made millionaire who has written nine consecutive New York Times bestsellers. His book, “The Automatic Millionaire,” spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the New York Times, Wall Street Journal, BusinessWeek and USA Today bestseller lists.He has been a contributor to NBC’s Today Show, appearing more than 100 times, as well as a regular on ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, and PBS. He has also been profiled in many major publications, including the New York Times, BusinessWeek, USA Today, People, Reader’s Digest, Time, Financial Times, Washington Post, the Wall Street Journal, Working Woman, Glamour, Family Circle, Redbook, Huffington Post, Business Insider, Investors’ Business Daily, and Forbes.

Friday, February 15, 2019

Midtown's Newly Opened City Tap Launches Lunch Menu

ATLANTA -- City Tap,

the American gastropub that just opened in Midtown Atlanta, is

launching lunch service. Available Monday through Sunday beginning at

11am, the new offerings are crafted by Executive Chef Greg Gettles.

On

the lunch menu, diners will find dishes such as Baked Oysters, made

with ham hock, spinach, corn, parmesan, and cornbread crumbs; Shaved

Apple & Gouda Salad, served with arugula, sharp gouda, apples,

candied pecans, and cider vinaigrette; Jumbo Lump Crab Cake Sandwich,

topped with fried green tomato, tartar sauce, and sweet potato slaw; and

Tandoori Kabobs (Chicken or Tofu), served with hummus, tabbouleh salad,

pomegranate, balsamic, lemon oil, and cilantro.

Those

items can be paired with City Tap's craft beer offerings, numbering in

the dozens with picks from both local breweries – like Monday Night

Brewing, Orpheus Brewing, Wild Heaven Beer, SweetWater Brewery, and New

Realm Brewing – and international beer makers.

City

Tap also serves happy hour and dinner from 3pm to midnight Monday

through Thursday, 3pm to 2am Friday and Saturday, and 3pm to 10pm on

Sundays.

makers.

City Tap also serves happy hour and dinner from 3pm to midnight Monday through Thursday, 3pm to 2am Friday and Saturday, and 3pm to 10pm on Sundays.

Thursday, February 14, 2019

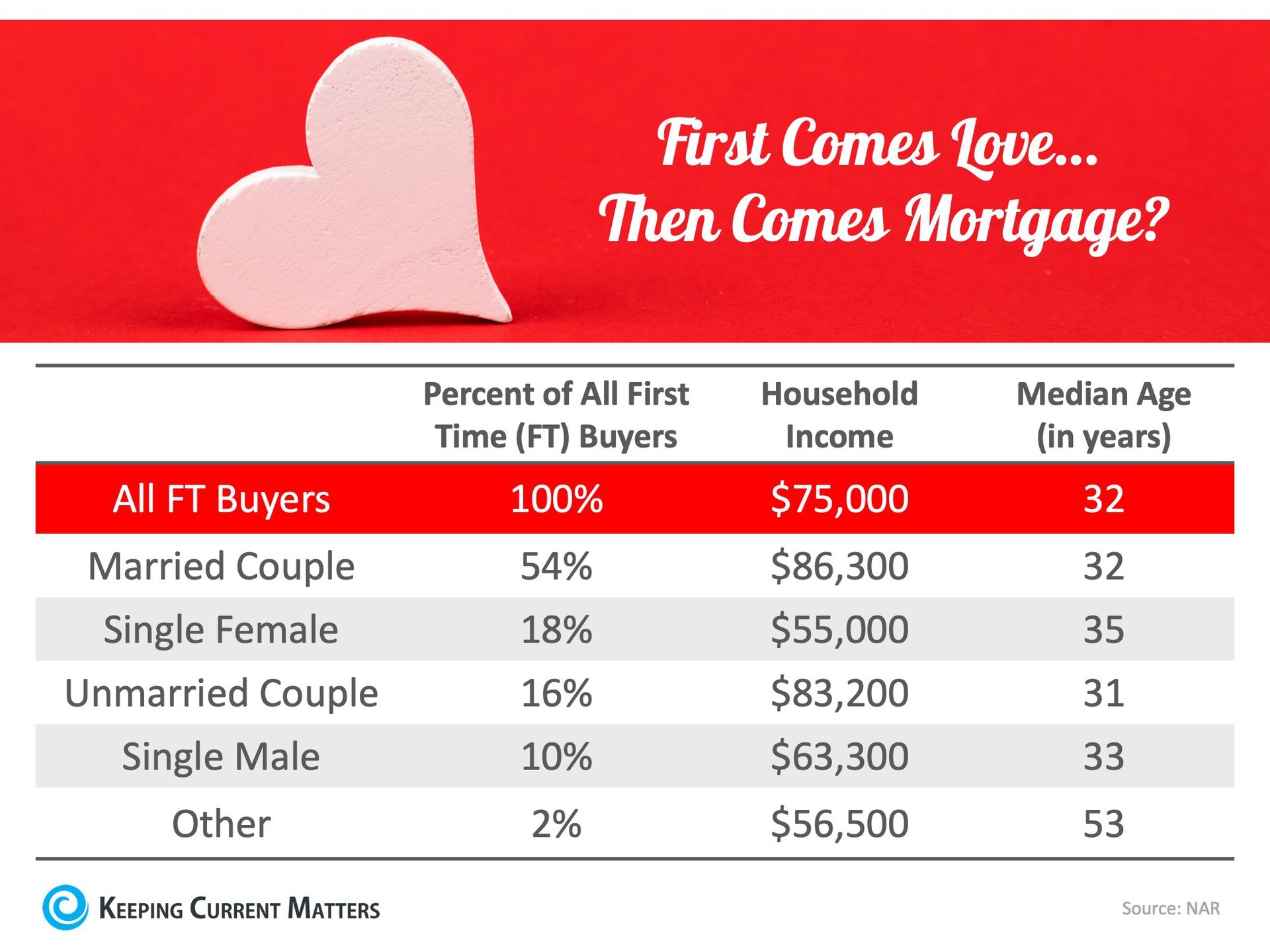

First Comes Love… Then Comes Mortgage? Couples Lead the Way

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers, married couples once again dominated the first-time homebuyer statistics in 2018 at 54% of all buyers. It is no surprise that buying a home is more attainable with two incomes to save for down payments and contribute to monthly housing costs.

However, many couples are also deciding to buy a home before spending what would be a down payment on a wedding. Last year, unmarried couples accounted for 16% of all first-time buyers.

If you’re single, don’t fret! Single women made up 18% of first-time buyers in 2018, while single men accounted for 10% of buyers. One recent article pointed to a sense of responsibility and commitment that drives many single women to want to own their home, rather than rent.

Here is the breakdown of all first-time homebuyers in 2018 by percentage of all buyers, income, and age:

Bottom Line

Bottom Line

You may not be that much different than those who have already purchased their first homes. Meet with a local real estate professional today to determine if your dream home is already within your grasp!

Wednesday, February 13, 2019

When It's Important...Find the Facts

Most parents don't put a lot of credence in the statements "Everyone is doing it" and "No one does that anymore." They'll dig a little deeper and get the facts of the situation. Interestingly, when it comes to buying a home, similar common myths continue to prevail surrounding what it takes to buy a home.

One of the most common myths is that it takes 20% down payment to get into a home. Certainly, an 80% mortgage might have the most favorable interest rate. It won't require mortgage insurance and qualifying requirements might be a little less but there are alternatives.

"88% of all buyers financed their homes last year and consistent with previous years, younger buyers were more likely to finance their home purchase. In 2018, the median down payment was 13% for all buyers, 7% for first-time buyers and 16% for repeat buyers." Stated by the 2018 NAR Profile of Buyers and Sellers.

- Qualified Veterans are eligible for zero down payment, 100% mortgage loans without mortgage insurance.

- Conventional loans are available with as little as 3-5% down payments.

- FHA mortgages have a 3.5% down payment.

- USDA mortgages for rural housing have two major products: one does not require a down payment and the other has a 3% down payment. Maps, based on population numbers, are available to determine if the area you're interested in purchasing in is eligible for a USDA mortgage.

The best approach, when it comes to buying a home, is to get the facts from a knowledgeable and trusted loan professional before you begin the home search process.

Tuesday, February 12, 2019

Monday, February 11, 2019

Thinking of Selling Your House? This is a Perfect Time!

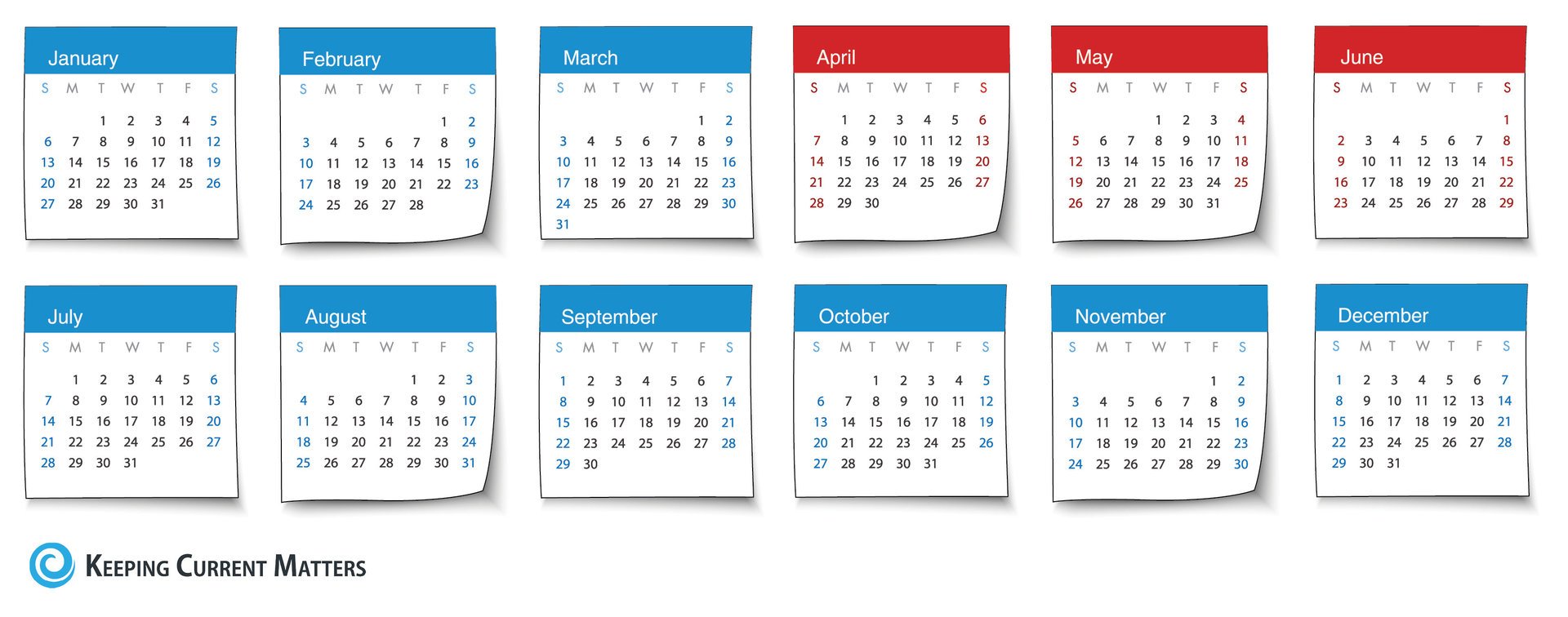

It is common knowledge that a great number of homes sell during the spring buying season. For that reason, many homeowners hold off putting their homes on the market until then. The question is whether or not that is a good strategy this year.

The other listings that come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market during this season in comparison to the rest of the year? The National Association of Realtors (NAR) recently revealed the months during which most people listed their homes for sale in 2018. This graphic shows the results:

The three months in the second quarter of the year (represented in

red) are consistently the most popular months for sellers to list their

homes on the market. Last year, the number of homes available for sale

in January was 1,520,000.

The three months in the second quarter of the year (represented in

red) are consistently the most popular months for sellers to list their

homes on the market. Last year, the number of homes available for sale

in January was 1,520,000.

That number spiked to 1,870,000 by May!

What does this mean to you?

With the national job situation improving and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring; they are out looking for homes right now.Bottom Line

If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition amongst buyers. Beat the rush of housing inventory that will enter the market and list your home today!Friday, February 8, 2019

5 Reasons to Love Hiring A Real Estate Pro [INFOGRAPHIC]

Highlights:

- Hiring a real estate professional to guide you through the process of buying a home or selling your house can be one of the best decisions you make!

- They are there for you to help with contracts, explaining the process, negotiations, and pricing (both when making an offer or setting the right price for your home).

- One of the top reasons to hire a real estate professional is their understanding of your local market and how the conditions in your neighborhood will impact your experience.

Thursday, February 7, 2019

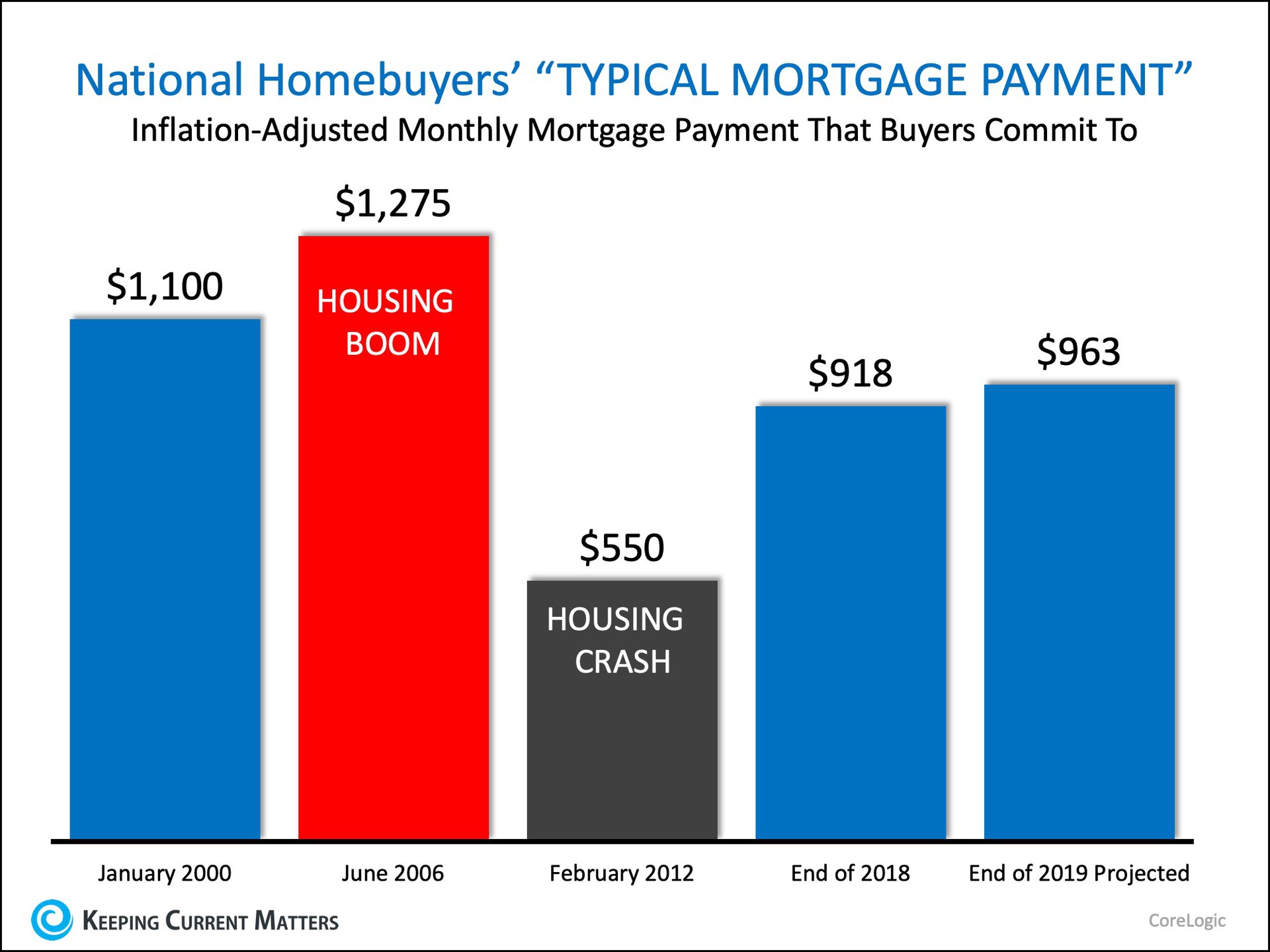

How to Get a Better Perspective on Affordability

Headlines spotlight the fact that buying a home is less affordable today than it was at any other time in more than a decade. Those headlines are accurate.

Understandably, buying a home is more expensive now than immediately following one of the worst housing crashes in American history. Over the past decade, the market was flooded with distressed properties (foreclosures and short sales) selling at 10-50% discounts. There were so many that this lowered the prices of non-distressed homes in the same neighborhoods. As a result, mortgage rates were kept low to help the economy.

Prices have since recovered. Mortgage rates have increased as the economy has gained strength. This has impacted housing affordability. However, it’s necessary to give historical context to the subject of affordability.

Two weeks ago, CoreLogic reported on what they call the “typical mortgage payment”. As they explain:

“One way to measure the impact of inflation, mortgage rates and home prices on affordability over time is to use what we call the ‘typical mortgage payment.’ It’s a mortgage-rate-adjusted monthly payment based on each month’s U.S. median home sale price. It is calculated using Freddie Mac’s average rate on a 30-year fixed-rate mortgage with a 20 percent down payment…Here is a graph showing the results of CoreLogic’s research:

The typical mortgage payment is a good proxy for affordability because it shows the monthly amount that a borrower would have to qualify for to get a mortgage to buy the median-priced U.S. home…

When adjusted for inflation, the typical mortgage payment puts homebuyers’ current costs in the proper historical context.”

As the graph indicates, the most recent calculation remained 28% below the all-time peak of $1,275 in June 2006. That’s because the average mortgage rate at that time was 6.68%. As seen in the graph, both today’s typical payment and CoreLogic’s projection for the end of the year are less than it was in January 2000.

Bottom Line

Even though home prices are appreciating at a slower rate, home affordability will likely continue to slide. However, this does not mean that buying a house is an unattainable goal in most markets. It is still less expensive today than it was prior to the housing bubble and crash.Wednesday, February 6, 2019

The KonMari Method: Helping You Prep Your House For Sale

One of the biggest challenges sellers face when listing their house is decluttering. Cleaning out some of the more personal decorating choices allows buyers to imagine themselves living in the house.

Those planning to sell soon are in luck! Marie Kondo, the inventor of the KonMari Method of Tidying Up, has gained popularity with her new Netflix series. She gives some great tips for sorting through years of accumulated possessions that we all collect in our homes.

“The KonMari Method™ encourages tidying by category – not by location – beginning with clothes, then moving on to books, papers, komono (miscellaneous items), and, finally, sentimental items. Keep only those things that speak to the heart, and discard items that no longer spark joy. Thank them for their service – then let them go.”When you subjectively look at all of your belongings, you can sort through the ones that mean the most to you. Not only will you increase space for more joy-bringing items in your new home, but you will also have a much easier time packing remaining belongings!

“Remember, tidying up isn’t about getting rid of stuff. It is about creating an environment that sparks joy and improves your quality of life.”When selling your house, first impressions matter! Before you or your agent schedule a photographer to take photos for your listing, make sure to tour your home with fresh eyes. Look for any imperfections that a buyer might notice.

When you sort through your more sentimental items, consider packing them away to ensure that you know where they all are. That way, they are safe during open houses and showing appointments. This will also cut down on the amount of packing you need to do right before you move!

Bottom Line

Whether you are selling your house to move up to a larger one, downsizing, or moving in with family, only bring the items that truly spark joy for you. This will not only help cut down on the items you move, but also ensures that you’re off to a great start in your new home!Tuesday, February 5, 2019

One More Time… You Do Not Need 20% Down to Buy a Home

The largest obstacle renters face when planning to buy a home is saving for a down payment. This challenge is amplified by rising rents, which has eaten into the amount of money renters have leftover for savings each month after paying expenses.

In combination with higher rents, survey after survey has shown that non-homeowners (renters and those living rent-free with family or friends) believe they need to save upwards of 20% for their down payment!

According to the “Barriers to Accessing Homeownership” study commissioned in partnership between the Urban Institute, Down Payment Resource, and Freddie Mac, 39% of non-homeowners and 30% of those who already own a home believe they need more than a 20% down payment.

The percentage of those who are aware of low down payment programs (those under 5%) is surprisingly low at 12% for non-homeowners and 13% for homeowners.

In a recent Convergys Analytics report, they found that 49% of renters believe they need at least a 20% down payment.

The median down payment on loans approved in 2018 was only 5%! Those waiting until they have over 20% may already have enough saved to buy now!

There are over 45 million millennials (33%) who are mortgage ready right now, meaning their income, debt, and credit scores would all allow them to qualify for a mortgage today!

Bottom Line

If your five-year plan includes buying a home, meet with a local real estate professional who can help you determine what it will take to make that plan a reality. You may be closer to your dream than you realize!Monday, February 4, 2019

Whose Mortgage Do You Want to Pay? Yours or Your Landlord’s?

There are some people who haven’t purchased homes because they are uncomfortable taking on the obligation of a mortgage. However, everyone should realize that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”With home prices rising, many renters are concerned about their house-buying power. Mike Fratantoni, Chief Economist at MBA, explained:

“The spring homebuying season is almost upon us, and if rates stay lower, inventory continues to grow, and the job market maintains its strength, we do expect to see a solid spring market.”As an owner, your mortgage payment is a form of ‘forced savings,’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

As mentioned before, interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.46% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.Friday, February 1, 2019

Who's throwing a #SuperBowl Party?

Highlights:

- Watching the big game at home with your friends & family offers many advantages.

- There’s more room to entertain a large crowd, and you don’t have to worry about complaints to your landlord if you cheer too loudly!

- The kitchen is big enough to make as many appetizers as you want, and if some of your guests are only there to watch the commercials, they can do so on a different TV in another room!

Subscribe to:

Comments (Atom)