If you’re currently renting and have dreams of owning your own home, it may be a good time to think about your next move. With rent costs rising annually and many helpful down payment assistance programs available, homeownership may be closer than you realize.

According to the 2018 Bank of America Homebuyer Insights Report, 74% of renters plan on buying within the next 5 years, and 38% are planning to buy within the next 2 years.

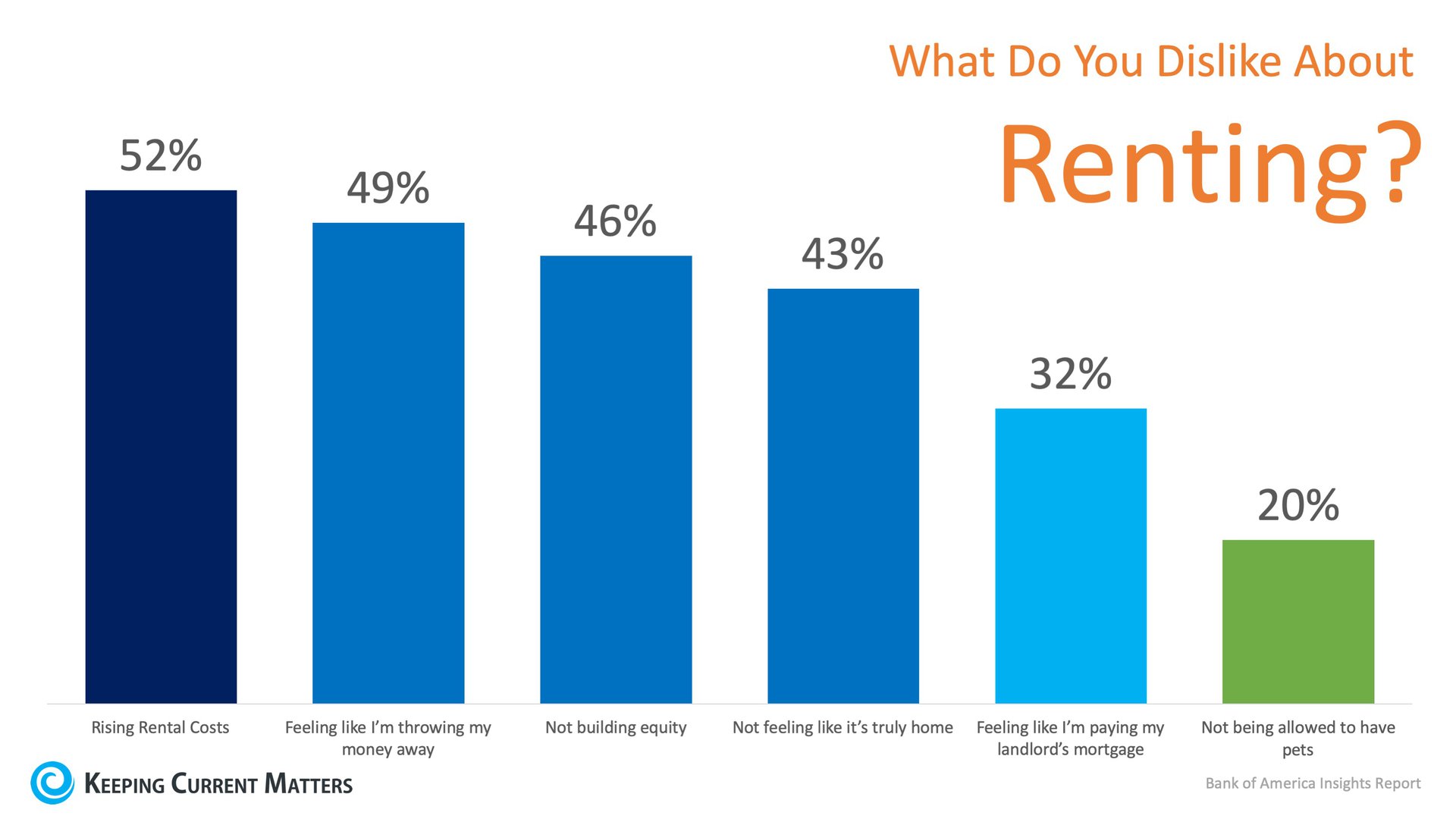

When those same renters were asked why they disliked renting, 52% said rising rental costs were their top reason, and 42% of renters believe their rent will rise every year. The full results of the survey can be seen below:

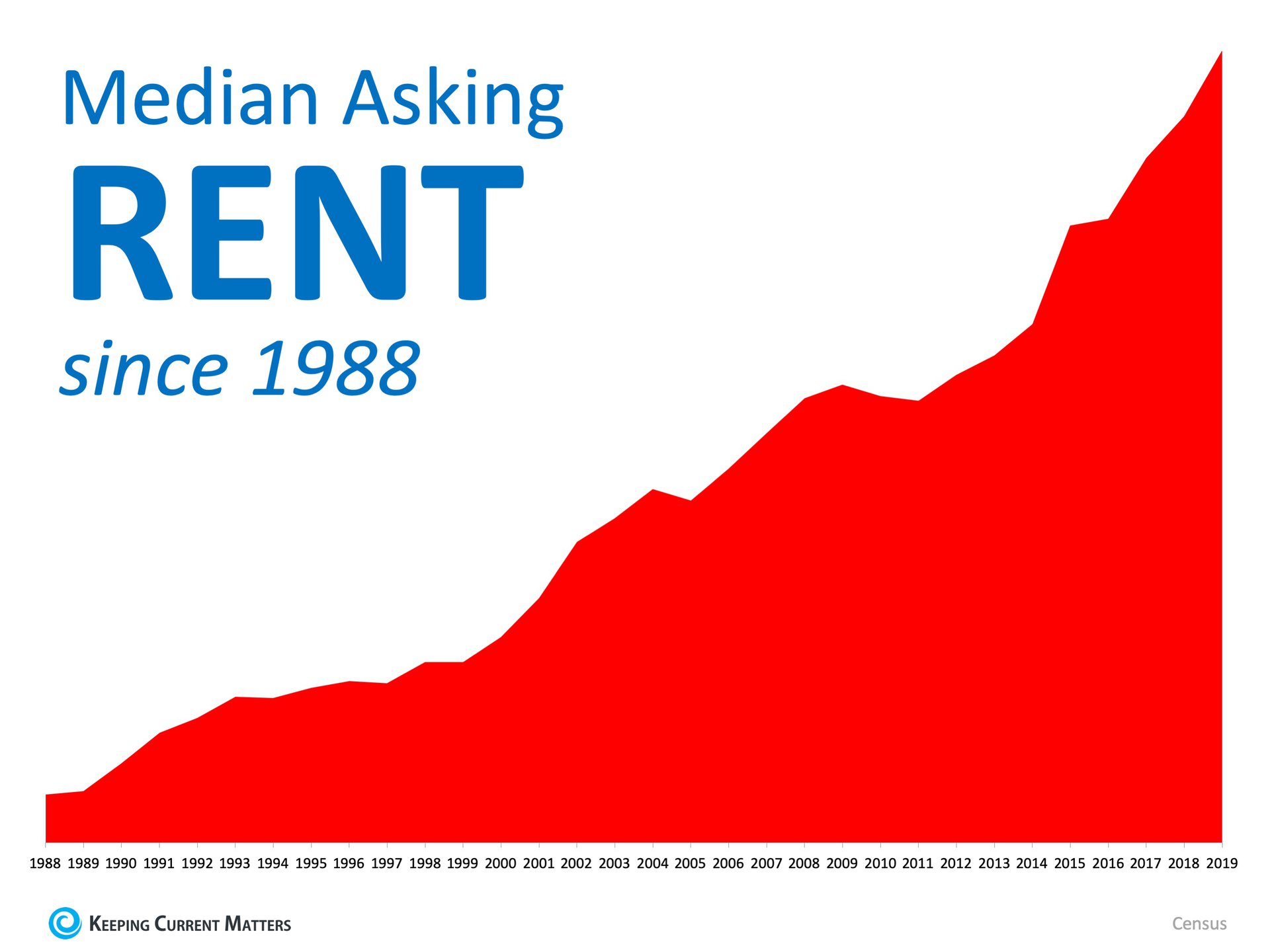

It’s no wonder rising rental costs came in as the top answer. The median asking rent price has risen steadily over the last 30 years, as you can see below.

It’s no wonder rising rental costs came in as the top answer. The median asking rent price has risen steadily over the last 30 years, as you can see below.

The reality is, the need to produce a 20% down payment is one of the biggest misconceptions of homeownership, especially for first-time buyers. That means a large number of renters may be able to buy now, and they don’t even know it.

No comments:

Post a Comment