A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage.

For many, the mortgage process can be scary, but it doesn’t have to be!

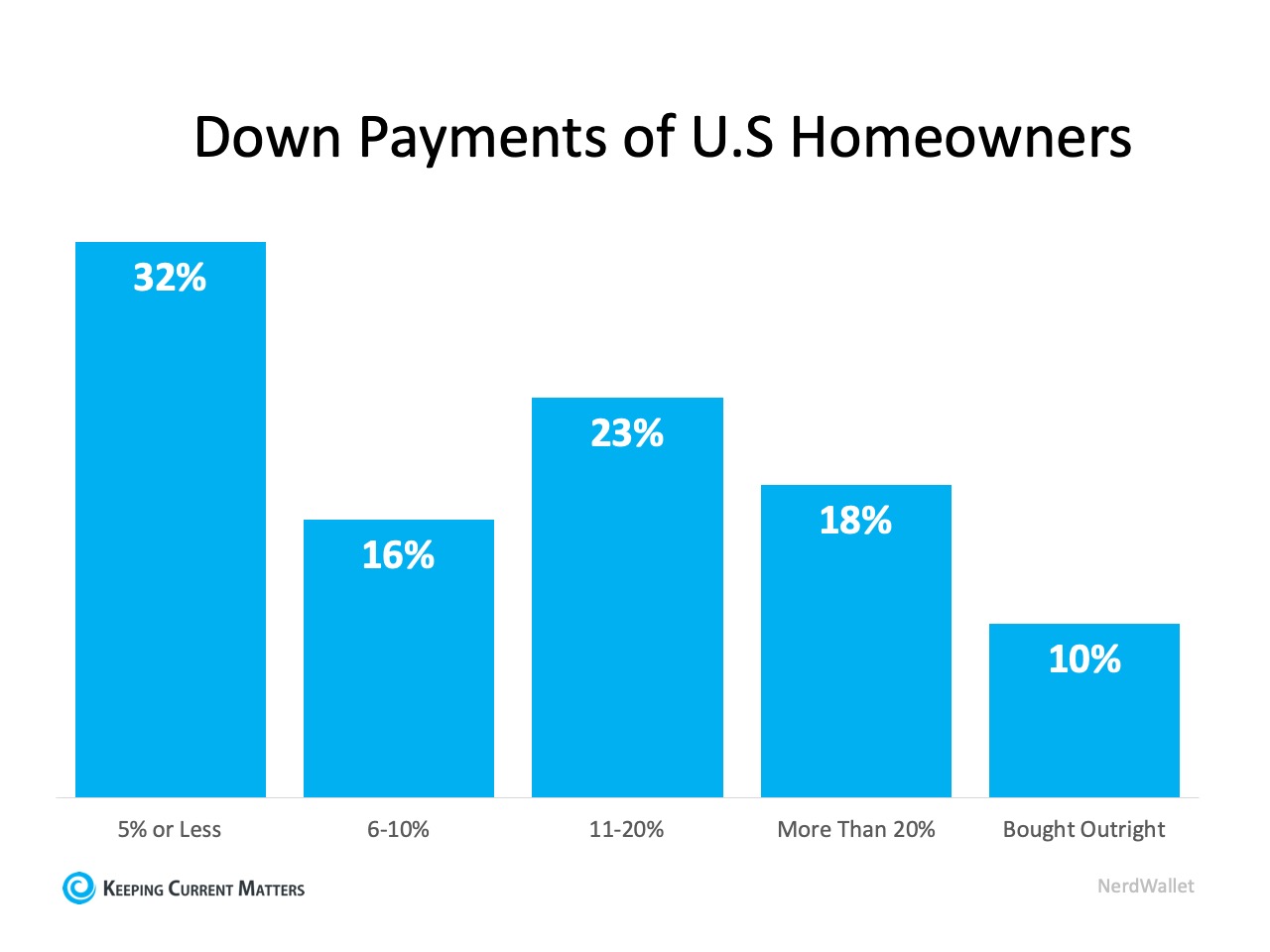

In order to qualify in today’s market, you’ll need a down payment (the average down payment on all loans last year was 5%, with many buyers putting down 3% or less), a stable income, and a good credit history.Once you’re ready to apply, here are 5 easy steps Freddie Mac suggests to follow:

- Find out your current credit history and credit score–

Even if you don’t have perfect credit, you may already qualify for a

loan. The average FICO Score® for all closed loans in September was 737,

according to Ellie Mae.

- Start gathering all of your documentation– This includes income verification (such as W-2 forms or tax returns), credit history, and assets (such as bank statements to verify your savings).

- Contact a professional– Your real estate agent will be able to recommend a loan officer who can help you develop a spending plan, as well as help you determine how much home you can afford.

- Consult with your lender– He or she will review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

- Talk to your lender about pre-approval– A pre-approval letter provides an estimate of what you might be able to borrow (provided your financial status doesn’t change) and demonstrates to home sellers that you’re serious about buying.