Popcorn is great for lots of stuff. You can enjoy a big bucket with

family and friends while at the movies, string it on a thread to give

Christmas that old-fashioned touch and even turn it into questionable

“treats” for Halloween. One place that it’s a lot less welcome is on the

ceiling.

Unfortunately, too many homes still have popcorn ceilings. They often create a lot more questions than they answer.

What Is a Popcorn Ceiling?

Back in the day, someone had a brilliant idea.

What would happen if there was a cheaper alternative to meticulously applied plaster ceiling coating and decoration for homes? This person asked themselves.

Well, that would be just lovely!

And that person wasn’t wrong in concept. It was practice that turned out to really be the killer.

Popcorn ceilings, the solution to the problem, are still around,

largely haunting homes built between the 1930s and 1990s. The ceiling

texture that oddly resembles cottage cheese far more than it does

popcorn, was popular for its ease of application and, at the time, low

maintenance requirement.

Popcorn Ceilings: The Kicker

Even if you don’t object to the generally dated appearance of a

popcorn ceiling (hey, maybe retro’s your thing, we’re not judging),

think twice before going all in because that house you’re looking at has

one that’s still intact.

So many popcorn ceilings contain

some amount of friable asbestos

that they are generally not a great idea to keep around. Even though

popcorn ceiling mixtures containing asbestos were banned under the Clean

Air Act in 1979, the remaining mixes that hadn’t been purchased were

still allowed to be sold. In some areas, this means that new

installations of potentially hazardous popcorn ceilings lingered well

into the 1980s.

If the asbestos wasn’t enough, many popcorn ceilings have been

painted since they were installed, or were installed using paint as part

of the initial mix. Lead-based paint was the norm until it was banned

in 1978. It’s kind of a double-whammy.

Friable Versus Non-Friable Asbestos

There are two kinds of asbestos: friable and non-friable. Friable

asbestos is the most dangerous kind, since any amount of disturbance can

result in particles floating around in the air and being inhaled. This

is not good news. Risks of free-floating asbestos can range from lung

scarring to mesothelioma, an insidious and heartbreaking form of cancer.

This is the kind in popcorn ceilings.

While non-friable asbestos isn’t a picnic, it’s a lot safer because

the asbestos is encapsulated within another material. For example, older

homes often have siding made of cement fiber-board tiles. These often

contain asbestos, but unless you’re cutting the tiles, it’s safely

contained.

There are very specific laws about dealing with both types of

asbestos, but those surrounding friable asbestos are as much about

protecting humans around the material as the environment. In most areas,

homeowners are legally allowed to remove popcorn ceilings from their

own homes, but it’s still a really good idea to at least have a test for

asbestos before you try it.

Before You Even Think About Scraping That Ceiling

There are few things easier than removing a popcorn ceiling. A

scraper and a lot of time will do the job, but the hazard to someone who

goes in blindly cannot be understated. So, before you even think about

scraping that ceiling, take some samples. Carefully.

Send one to a lab for testing for asbestos. Send another for testing

for lead based paint (or use a high-quality at-home test kit). Wait

until you have results to move forward.

If you test positive for either or both, consider calling in a pro.

They have all the right equipment to ensure that asbestos doesn’t get

loose in your home, where you, your family and your pets will be at risk

of exposure. If you DIY this one, do not skimp on ventilators and other

filters to keep any friable asbestos contained.

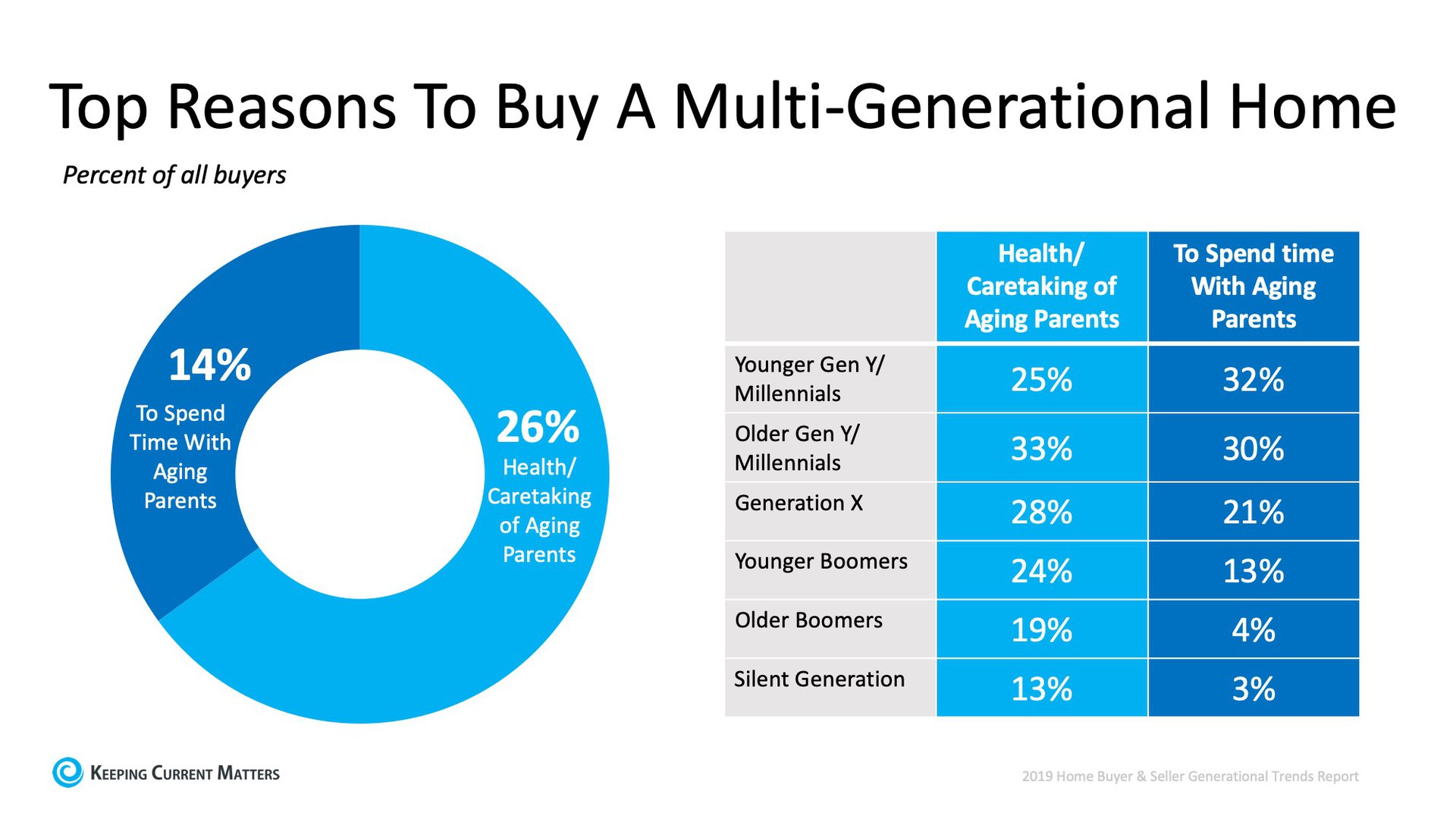

An

increasing number of studies affirm the benefits of being part of a

multigenerational household. These benefits aren’t just for the

grandchildren, but for the grandparents as well. According to these two

resources:

An

increasing number of studies affirm the benefits of being part of a

multigenerational household. These benefits aren’t just for the

grandchildren, but for the grandparents as well. According to these two

resources: