If your DIY ambitions have reached epic proportion and you’re ready to

take on painting your home’s exterior solo, weigh the decision carefully

before proceeding. You’ll need to decide if you have the time and

patience to do a detailed and thorough job. If you’re ready, willing and

able, here’s how HGTV recommends going about it:

Step 1: Prep Your Surface

Priming your home’s exterior is essential to a good result. If you’re

painting a new stucco home, let it cure for at least 28 days, otherwise

the paint will not adhere properly. If you’re repainting an existing

home, check for peeling, chipping, mildew, etc. Remove mildew by using a

garden sprayer to apply a chlorine bleach solution, then use a pressure

washer to remove dirt and old paint from the entire exterior.

Step 2: Caulk and Patch

Use caulk to seal any cracks and joints where one type of exterior comes

up against a different type of exterior, such as window frames, door

frames, molding and fascia boards. Patch chips in an older stucco

surface with new stucco - allowing time for it to cure - and replace

wood siding or fascia boards that show any signs of rotting. Gently sand

wood trim and doors to ensure an ideal surface for painting.

Step 3: Prime

Primer is key to a good paint job as it has a high resin content that

locks old paint in place and creates a healthy surface for new paint to

adhere to. If you are repainting walls that have become chalky or dusty,

select a chalky wall sealer. Paint will not stick to a dusty surface.

When dealing with new construction, latex primer works well for vinyl

and most wood siding. Check the label on your primer or sealer to

determine how long to wait before you begin painting.

Step 4: Choose Quality Paint

Opt for a 100-percent acrylic latex paint for your home’s exterior.

Better quality paints are usually higher in volume solids and have

better binders to help hold pigments in place longer, improving the

durability of your paint job. Check the manufacturer's website or ask

your local distributor for a Technical Data Sheet, to determine a

paint’s level of volume solids, but generally speaking, those labeled

"premium" or "super-premium" are higher in volume solids than budget

brands.

Step 5: Choose an Appealing Color

This may seem like an obvious step, but it’s really the most important

one - not to mention potentially overwhelming - so do some research.

Investigate your neighborhood to see what you like on other houses, but

take into consideration the style of your home. Choose a color that

complements your roofing and any brick or stone accents you may have. If

you’re having trouble deciding, paint samples on your home’s exterior

and study how it looks at different parts of the day. And keep in mind

that vibrant colors will fade faster.

Step 6: Time to Paint

The ideal way to paint exterior walls is called spraying and

back-rolling. This method requires two people, one to apply paint with a

sprayer, another to follow behind with a roller. This delivers an even

finish, particularly on textured surfaces like stucco. If your budget

allows, apply a second coat after the recommended dry time. Muted colors

cover better than bright ones, which may require a second coat to get

the full color.

Step 7: The Details

The last step is to paint the doors, fascia, molding, shutters and other

decorative details. Use a good brush or 6-inch "hot dog" rollers.

Remember, there are no short cuts, so be prepared to invest the

necessary time. And it will be worth it - a quality paint job can last

10 years in the right climate.

Source: HGTV.com

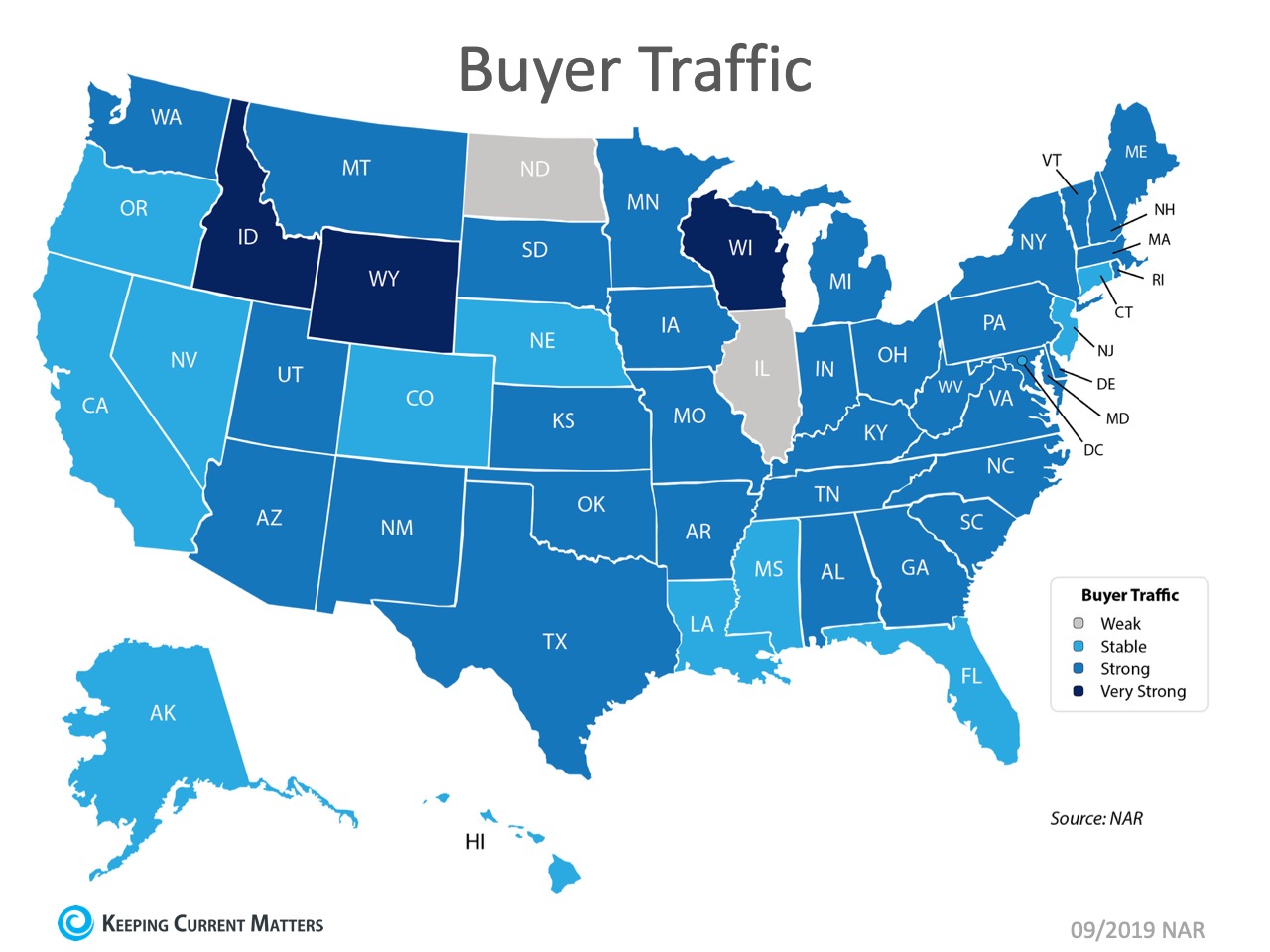

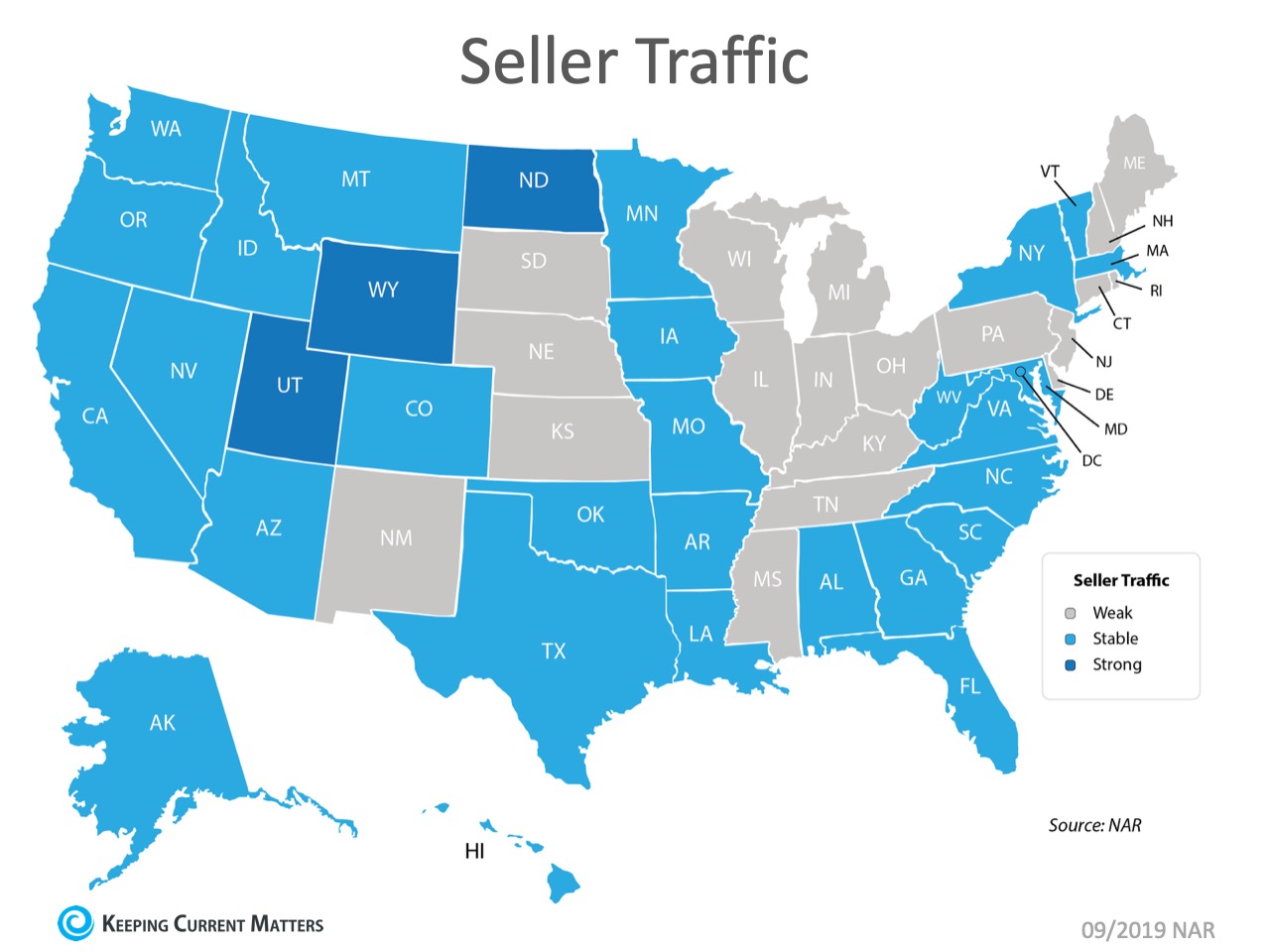

The

darker the blue, the stronger the demand for homes is in that area. The

survey shows that in 3 of the 50 U.S. states, buyer demand is now very

strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer

demand is slightly lower than this time last year but remains strong.

The

darker the blue, the stronger the demand for homes is in that area. The

survey shows that in 3 of the 50 U.S. states, buyer demand is now very

strong; only 2 of the 50 states have a ‘weak’ demand. Overall, buyer

demand is slightly lower than this time last year but remains strong. As

the map below shows, 18 states reported ‘weak’ seller traffic, 29

states and Washington, D.C. reported ‘stable’ seller traffic, and 3

states reported ‘strong’ seller traffic. This means there are far fewer

homes on the market than what is needed to satisfy the buyers who are

looking for homes.

As

the map below shows, 18 states reported ‘weak’ seller traffic, 29

states and Washington, D.C. reported ‘stable’ seller traffic, and 3

states reported ‘strong’ seller traffic. This means there are far fewer

homes on the market than what is needed to satisfy the buyers who are

looking for homes.