Wednesday, November 30, 2016

Tuesday, November 29, 2016

Mortgage Interest Rates Just Went Up... Should I Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased over the last several weeks. Along with Freddie Mac, Fannie Mae, the Mortgage Bankers Association and the National Association of Realtors

are all calling for mortgage rates to continue to rise over the next

four quarters.

This has caused some purchasers to lament the fact they may no longer be

able to get a rate less than 4%. However, we must realize that current

rates are still at historic lows.

Here is a chart showing the average mortgage interest rate over the last

several decades.

Bottom Line

Though you may have missed getting the lowest mortgage rate ever

offered, you can still get a better interest rate than your older

brother or sister did ten years ago; a lower rate than your parents did

twenty years ago and a better rate than your grandparents did forty

years ago.

Monday, November 28, 2016

Friday, November 25, 2016

What You Need to Know About the Mortgage Process [INFOGRAPHIC]

Some Highlights:

- According to Freddie Mac, 40% of buyers are putting less than 10% down, with many putting down as little as 3%.

- Have a budget and stick to it!

- Know your credit score and history!

- Reach out to a professional who can help you with the process!

Wednesday, November 23, 2016

Thinking of Selling? Don't Overlook an Outdated Kitchen, Buyers Won't

If you are planning on listing your home for sale, make sure that you don't overlook the condition of your kitchen. A recent article on realtor.com listed "7 Signs Your Kitchen Is Way Overdue for a Renovation," in which they warned:

Kitchen remodels can be pricey, with many complete remodels costing $20,000 or more. But not every kitchen needs a full remodel. There are many smaller projects that will help buyers see themselves trying their favorite Pinterest recipe in your home! Here are a couple of project ideas that, if you're handy or know someone who is, could end up boosting your home's value without breaking the bank:

"Dated kitchens--just like bathrooms--are a major barrier for resale. Buyers want modern amenities and styling, and most aren't interested in renovating post-purchase."

Kitchen remodels can be pricey, with many complete remodels costing $20,000 or more. But not every kitchen needs a full remodel. There are many smaller projects that will help buyers see themselves trying their favorite Pinterest recipe in your home! Here are a couple of project ideas that, if you're handy or know someone who is, could end up boosting your home's value without breaking the bank:

- Are the cabinets in good shape but need an update? A new coat of paint and some updated hardware will instantly freshen up the space and drastically change the feel of the room all for under $300.

- A new backsplash to match the freshly painted cabinets updates the space and adds some style while staying under $200, depending on the size of the room.

- If the kitchen seems dark, consider adding LED under cabinet lighting for around $40.

- If replacing the countertops in the kitchen isn't within your budget, consider using a top coat to cover the current countertops.

"Eighty-two percent of homeowners said their updated kitchen gave them a greater desire to be at home, and 95% were happy or satisfied with the result."

Bottom Line

Kitchens and bathrooms are often make or break for buyers when touring a home or searching through photo galleries online. Consult a local real estate professional who can help you identify which small projects could pay off big!How Proximity Affects Home Value

Real estate is all about location, location, location! It’s no surprise that what affects home value more than anything else is your proximity to certain places (or people). This infographic takes a look at exactly just how important that can be! Here’s how various factors help or hurt a home depending on their nearness to the property.

Tuesday, November 22, 2016

Why Are Mortgage Interest Rates Increasing?

According to Freddie Mac's latest Primary Mortgage Market Survey, the 30-year fixed rate mortgage interest rate jumped up to 3.94% last week. Interest rates had been hovering around 3.5% since June, and many are wondering why there has been such a significant increase so quickly. Why did rates go up?

Whenever there is a presidential election, there is uncertainty in the markets as to who will win. One way that this is noticeable is through the actions of investors. As many investors pull their funds from the more volatile and less predictive stock market and instead, choose to invest in Treasury Bonds. When this happens, the interest rate on Treasury Bonds does not have to be as high to entice investors to buy them, so interest rates go down. Once the elections are over and a President has been elected, investors return to the stock market and other investments, leaving the Treasury to raise rates to make bonds more attractive again. Simply put, the better the economy, the higher interest rates will go. For a more detailed explanation of the many factors that contribute to whether interest rates go up or down, you can follow this link to Investopedia.The Good News

Even though rates are closer to 4% than they have been in nearly 6 months, they are still slightly below where we started 2016, at 3.97%. The great news is that even at 4%, rates are still significantly lower than they have been over the last 4 decades, as you can see in the chart below.

Any increase in interest rate will impact your monthly housing costs when you secure a mortgage to buy your home. A recent Wall Street Journal article points out that,"While still only roughly half the average over the past 45 years, according to Freddie Mac, the quick rise has lenders worried that home loans could become more expensive far sooner than anticipated." Tom Simons, a Senior Economist at Jefferies LLC, touched on another possible outcome for higher rates:"First-time buyers look at the monthly total, at what they can afford, so if the mortgage is eaten up by a higher interest expense then there's less left over for price, for the principal. Buyers will be shopping in a lower price bracket; thus demand could shift a bit."

Bottom Line

Interest rates are impacted by many factors, and even though they have increased recently, rates would have to reach 9.1% for renting to be cheaper than buying. Rates haven't been that high since January of 1995, according to Freddie Mac.

Monday, November 21, 2016

Friday, November 18, 2016

Thursday, November 17, 2016

From Empty Nest to Full House... Multigenerational Families Are Back!

Multigenerational homes are coming back in a big way! In the 1950s,

about 21%, or 32.2 million Americans shared a roof with their grown

children or parents. According to a recent Pew Research Center report, the number of multigenerational homes dropped to as low as 12% in 1980 but has shot back up to 19%, roughly 60.6 million

people, as recently as 2014.

Multigenerational households typically occur when adult children (over

the age of 25) either choose to, or need to, remain living in their

parent's home, and then have children of their own. These households

also occur when grandparents join their adult children and grandchildren

in their home.

According to the National Association of Realtors' (NAR) 2016 Profile of Home Buyers and Sellers, 11% of home buyers purchased multigenerational homes last year.

The top 3 reasons for purchasing this type of home were:

The top 3 reasons for purchasing this type of home were:

- To take care of aging parents (19%)

- Cost savings (18%, up from 15% last year)

- Children over the age of 18 moving back home (14%, up from 11% last year)

Bottom Line

Multigenerational households are making a comeback. While it is a shift from the more common nuclear home, these households might be the answer that many families are looking for as home prices continue to rise in response to a lack of housing inventory.Wednesday, November 16, 2016

You Can Never Have TMI about PMI

When it comes to buying a home, whether it is your first time or your

fifth, it is always important to know all the facts. With the large

number of mortgage programs available that allow buyers to purchase a

home with a down payment below 20%, you can never have Too Much Information (TMI) about Private Mortgage Insurance (PMI).

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

What is Private Mortgage Insurance (PMI)?

Freddie Mac defines PMI as:"An insurance policy that protects the lender if you are unable to pay your mortgage. It's a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%. Once you've built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment."As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that:

"The cost of PMI varies based on your loan-to-value ratio - the amount you owe on your mortgage compared to its value - and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed."According to the National Association of Realtors, the average down payment for all buyers last year was 10%. For first-time buyers, that number dropped to 6%, while repeat buyers put down 14% (no doubt aided by the sale of their home). This just goes to show that for a large number of buyers last year, PMI did not stop them from buying their dream homes. Here's an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

"It's no doubt an added cost, but it's enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment."

Bottom Line

If you have questions about if you should buy now or wait until you've saved a larger down payment, meet with a professional in your area who can explain your market's conditions and help you make the best decision for you and your family.Tuesday, November 15, 2016

A Lack of Listings Remains 'Huge' Challenge in the Market

The housing crisis is finally in the rearview mirror as the real estate market moves down the road to a complete recovery. Home values are up, home sales are up, and distressed sales (foreclosures & short sales) are at their lowest mark in over 8 years. This has been, and will continue to be, a great year for real estate. However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. According to the National Association of Realtors (NAR), buyer traffic and demand continues to be the strongest it has been in years. The supply of homes for sale has not kept up with this demand and has driven prices up in many areas as buyers compete for their dream home. Traditionally, the winter months create a natural slowdown in the market. Jonathan Smoke, Chief Economist at realtor.com, points to low interest rates as one of the many reasons why buyers are still out in force looking for a home of their own.

"Overall, the fundamental trends we have been seeing all year remain solidly in place as we enter the traditionally slower sales season, and pent-up demand remains substantial as buyers seek to get a home under contract while rates remain so low."NAR's Chief Economist, Lawrence Yun, points out that the inventory shortage we are currently experiencing isn't a new challenge by any means:

"Inventory has been extremely tight all year and is unlikely to improve now that the seasonal decline in listings is about to kick in. Unfortunately, there won't be much relief from new home construction, which continues to be grossly inadequate in relation to demand."

Bottom Line

Healthy labor markets and job growth have created more and more buyers who are not just ready and willing to buy but are also able to. If you are debating whether or not to put your home on the market this year, now is the time to take advantage of the demand in the market.Monday, November 14, 2016

Why Waiting Until After the Holidays to Sell Isn't a Smart Decision

Every year at this time, many homeowners decide to wait until after the holidays to put their homes on the market for the first time, while others who already have their homes on the market decide to take them off until after the holidays. Here are six great reasons not to wait:

- Relocation buyers are out there. Companies are not concerned with holiday time and if the buyers have kids, they want them to get into school after the holidays.

- Purchasers that are looking for a home during the holidays are serious buyers and are ready to buy.

- You can restrict the showings on your home to the times you want it shown. You will remain in control.

- Homes show better when decorated for the holidays.

- There is less competition for you as a seller right now. Let's take a look at listing inventory as compared to the same time last year:

- The supply of listings increases substantially after the holidays. Also, in many parts of the country, new construction will continue to surge reaching new heights in 2017, which will lessen the demand for your house.

Bottom Line

Waiting until after the holidays to sell your home probably doesn't make sense.Friday, November 11, 2016

The Truth About Housing Affordability

From a purely economic perspective, this is one of the best times in American history to buy a home. Black Night Financial Services discusses this in their most recent Monthly Mortgage Monitor. Here are two of the report's revelations:

- The average U.S. home value increased by $13,500 from last year, but low interest rates have kept the monthly principal & interest payment needed to purchase a median-priced home almost equal to one year ago.

- Home affordability still remains favorable compared to long-term historic norms.

"Even though the value of the average home in the U.S. increased by about $13,500 over the last year, thanks to declining interest rates it actually costs almost exactly the same in principal and interest each month to purchase as it did this time last year. Even taking into account the fact that affordability can vary - sometimes significantly - across the country based upon the different rates of home price appreciation we're seeing, that's a pretty incredible balancing act between interest rates and home prices at the national level... Right now, it takes 20 percent of the median monthly income to cover monthly payments on the median-priced home, which is well below historical norms." However, the report warns that affordability will be dramatically impacted by an increase in mortgage rates. "A half-point increase in interest rates would be equivalent to a $17,000 jump in the average home price, and bring that ratio to 21.5 percent. This increase is still below historical norms, but puts more pressure on homebuyers."

Bottom Line

If you are ready and willing to purchase a home of your own, find out if you're able to. Now is a great time to jump in.Thursday, November 10, 2016

Getting ready to sell? Move your property fast – and for the highest

price possible – with these affordable tricks. These easy changes will

make your home more attractive to potential buyers, and you can start at

any stage in the selling process. timgrissett.com

Wednesday, November 9, 2016

Real Estate Hidden Gems

Pricing a home is more art than science. Get beyond the standard

information you can search online like square footage, bedrooms,

bathrooms, year built, etc. Homebuyers should be on the lookout for some

of these hidden gems that may be undervalued (or not even included) in

the listing price.

Tuesday, November 8, 2016

It's Not Always Marriage Before Mortgage

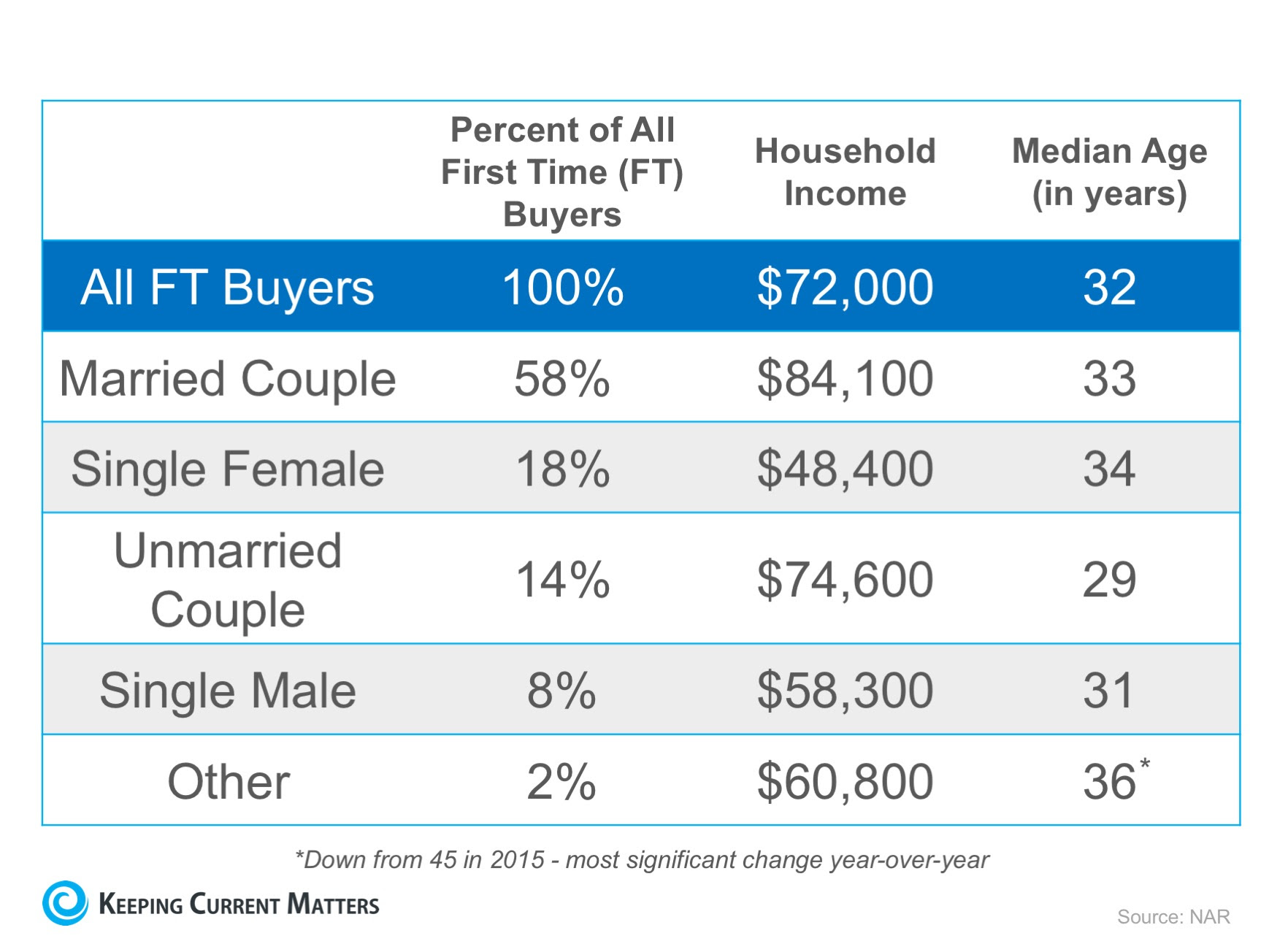

There are many people sitting on the sidelines trying to decide if they should purchase a home or sign a rental lease. Some might wonder if it makes sense to purchase a house before they are married and have a family. Others may think they are too young. And still, others might think their current income would never enable them to qualify for a mortgage. We want to share what the typical first-time homebuyer actually looks like based on the National Association of REALTORS most recent Profile of Home Buyers & Sellers. Here are some interesting statistics on the first-time buyer:

Unmarried couples jumped up to the third spot, right after their married counterparts and single women. Many couples are buying a home before spending what would be a down payment on a wedding.

Bottom Line

You may not be much different than many people who have already purchased their first home. Meet with a local real estate professional today who can help determine if your dream home is within your grasp.Monday, November 7, 2016

Bathrooms!

What do you think of this Stunning Victorian bathroom with white subway

tile, beautiful Moroccan tiles along the floor and shower, stainless

steel oversized shower head and a metallic freestanding tub???

Friday, November 4, 2016

The Difference an Hour Makes This Fall

Every Hour in the US Housing Market:

- 633 Homes Sell

- 253 Homes Regain Positive Equity

- Median Home Values Go Up $1.43

Thursday, November 3, 2016

What the current housing shortage means for you

If you've been thinking of trading up to a more luxurious home, you'll want to read this.

You may have heard that we're in the middle of a housing shortage.

It's certainly true for mid-market and lower-priced homes.

The number of such homes on the national market has declined over 40% in the last four years, and prices have increased accordingly.

There are a few different reasons behind this.

Builders have been focusing mostly on higher-priced homes. Investors have turned many lower-priced homes into rentals. More people are looking to buy thanks to historically low mortgage rates.

So yes, there’s a shortage...but what does this mean for you?

First, if you're looking to sell your home, the current market offers a great opportunity.

Thanks to the shortage in the market, you can sell your home more quickly.

This summer, the typical home stayed on the market for just 35 days, and 47% of homes sold in less than a month. Compare that to 2012, when the typical home was on the market for over two months!

You can also sell your home for more in today’s market. Prices are 5.3% higher now than they were a year ago, and many homes end up selling for more than their asking price.

Curious about how much your home is worth in the current market?

Taking into account recent sales, I can give you a good estimate of the current value of your home.

I mentioned that now is also a good time to trade up to a bigger, higher-priced home.

You see, prices of top-tier homes have grown at a slower rate than mid- and low-priced homes. In addition, 16% of top-tier homes over the last year sold for less than their asking price.

There is also a greater supply of premium homes — they now make up 46% of available homes on the market.

This means it’s a great time to buy a top-tier home.

What kinds of homes are for sale right now?

You may have heard that we're in the middle of a housing shortage.

It's certainly true for mid-market and lower-priced homes.

The number of such homes on the national market has declined over 40% in the last four years, and prices have increased accordingly.

There are a few different reasons behind this.

Builders have been focusing mostly on higher-priced homes. Investors have turned many lower-priced homes into rentals. More people are looking to buy thanks to historically low mortgage rates.

So yes, there’s a shortage...but what does this mean for you?

First, if you're looking to sell your home, the current market offers a great opportunity.

Thanks to the shortage in the market, you can sell your home more quickly.

This summer, the typical home stayed on the market for just 35 days, and 47% of homes sold in less than a month. Compare that to 2012, when the typical home was on the market for over two months!

You can also sell your home for more in today’s market. Prices are 5.3% higher now than they were a year ago, and many homes end up selling for more than their asking price.

Curious about how much your home is worth in the current market?

Taking into account recent sales, I can give you a good estimate of the current value of your home.

I mentioned that now is also a good time to trade up to a bigger, higher-priced home.

You see, prices of top-tier homes have grown at a slower rate than mid- and low-priced homes. In addition, 16% of top-tier homes over the last year sold for less than their asking price.

There is also a greater supply of premium homes — they now make up 46% of available homes on the market.

This means it’s a great time to buy a top-tier home.

What kinds of homes are for sale right now?

Wednesday, November 2, 2016

How Long Do Families Stay in a Home?

The National Association of Realtors (NAR) keeps historic data on many aspects of homeownership. One of the data points that has changed dramatically is the median tenure of a family in a home. As the graph below shows, for over twenty years (1985-2008), the median tenure averaged exactly six years. However, since 2008, that average is almost nine years - an increase of almost 50%.

Why the dramatic increase?

The reasons for this change are plentiful. The top two reasons are:- The fall in home prices during the housing crisis left many homeowners in a negative equity situation (where their home was worth less than the mortgage on the property).

- The uncertainty of the economy made some homeowners much more fiscally conservative about making a move.

What does this mean for housing?

Many believe that a large portion of homeowners are not in a house that is best for their current family circumstances. They could be baby boomers living in an empty, four-bedroom colonial, or a millennial couple planning to start a family that currently lives in a one-bedroom condo. These homeowners are ready to make a move. Since the lack of housing inventory is a major challenge in the current housing market, this could be great news.The Homebuying Process

It's your first time buying a home. Your family and friends are encouraging you and you know in your own mind, just what you want, but how do you go about buying your first piece of real estate. What should you be looking for? What do the contract terms mean? What steps are taken from the time of signing contract to the time of settlement? Following are some helpful hints and tips to guide you on the journey.

Tuesday, November 1, 2016

FHA 101

FHA is the largest insurer of residential mortgages in the world. FHA loan requirements and guidelines cover things like mortgage insurance, lending limits, debt to income ratios, credit issues, and closing costs. In order to prevent homebuyers from getting into a home they cannot afford, FHA guidelines have been set in place.

Subscribe to:

Comments (Atom)