Tuesday, February 28, 2017

5 Key Reasons to Have a Home Inspection Before You Buy

It’s easy to get swept up in the excitement of buying a new home and forget to make the important decision to have a home inspection performed before you sign the contract.

Home inspections are an instrumental part of the home-buying process that can save you a lot of time and money in the long run. Remember that a home appraisal and a home inspection are not the same thing. Appraisals will not provide you with a detailed look at a property that can help uncover deep-rooted problems and potential pitfalls.

Here are five great reasons to have a home inspection before you buy:

Don’t Judge a Book by Its Cover

Especially for those buying newer construction, a home inspection may feel like a waste of money. No matter the age of the home, there can be costly troubles unknown to the average buyer. Problems with wiring, plumbing and easement may not be visible during a showing and you’ll want to get an expert opinion.

Save Money

Home inspections generally cost from $300 to $500 depending on size and age of the home. That’s a good sum, but perhaps think of it this way: Those who skip out on the expense may realize in a few years that an inspection is much cheaper than rewiring the entire house.

Negotiate

One of the advantages of having a home inspection performed before you buy is the power it might give you to negotiate a lower price. If a home you’re really interested in is on the edge of your price range, information gathered during the home inspection may give you the bargaining power to talk down the price. You can also insert language into a purchase contract that allows you to back out of an agreement if the inspection turns up problems.

Seller’s Repairs

Not only are you able to negotiate a lower price, many buyers include clauses in their contract requiring the seller to make the repairs necessary before any money is exchanged. If the seller is unwilling to complete the repairs, estimate the cost and ask them to take that amount off the total. Solid facts about the quality and condition of the home can give you valuable bargaining power.

Know What You’re Buying

In the end the most important reason to have a home inspection before you buy is to really know what you’re buying. Research your potential home like you would any other major purchase. The more you know, the fewer surprises there will be down the road. Home inspectors can help you make a decision based on your current budget as well as your future time and money investment.

Monday, February 27, 2017

Death & Taxes

Want to know the tax savings on #mortgage interest you pay? https://www.mtgprofessor.com/calculators/Calculator8a.html

Friday, February 24, 2017

Thursday, February 23, 2017

Retire Without Rent

If you want to retire without rent, you need to start planning your mortgage now. We’ve compiled some stats about retirement age incomes and developed a formula to ensure anybody can go into their golden years with equity under their belt and bills off their minds.

Retirement age is 65. The average social security payout per month is $1,180.80. The average 401k at the time of retirement is just north of $100,000 as of 2015, meaning there’s a monthly payout of roughly $270.77. Unfortunately the average mortgage payment int he U.S. is $1,061. That’s almost the entirety of an retiree’s expected $1,451.57 monthly income.

The average age for a first time home buyer is 31, and the average income is $61,800. So if you buy a house at 31 and get a 30 year fixed rate mortgage, that still leaves you 4 years for unforeseen circumstances and major upgrades. Then you can retire at 65 with equity and no debts!

The Impact of Homeownership on Family Health

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:

“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”Today, we want to cover the section of the report that quoted several studies concentrating on the impact homeownership has on the health of family members. Here are some of the major findings on this issue revealed in the report:

- There is a strong positive relationship between living in poor housing and a range of health problems, including respiratory conditions such as asthma, exposure to toxic substances, injuries and mental health. Homes of owners are generally in better condition than those of renters.

- Findings reveal that increases in housing wealth were associated with better health outcomes for homeowners.

- Low-income people who recently became homeowners reported higher life satisfaction, higher self-esteem, and higher perceived control over their lives.

- Homeowners report higher self-esteem and happiness than renters. For example, homeowners are more likely to believe that they can do things as well as anyone else, and they report higher self-ratings on their physical health even after controlling for age and socioeconomic factors.

- Renters who become homeowners not only experience a significant increase in housing satisfaction but also obtain a higher satisfaction even in the same home in which they resided as renters.

- Social mobility variables, such as the family financial situation and housing tenure during childhood and adulthood, impacted one’s self-rated health.

- Homeowners have a significant health advantage over renters, on average. Homeowners are 2.5 percent more likely to have good health. When adjusting for an array of demographic, socioeconomic, and housing–related characteristics, the homeowner advantage is even larger at 3.1 percent.

Bottom Line

People often talk about the financial benefits of homeownership. As we can see, there are also social benefits of owning your own home.Wednesday, February 22, 2017

RESALE ROI

How to get the biggest resale bang for your buck! If you're considering

listing your home or condo for sale, give me a call for a market

analysis. timgrissett.com

Tuesday, February 21, 2017

Access: A Key Component in Getting Your House SOLD!

So, you’ve decided to sell your house. You’ve hired a real estate professional to help you with the entire process, and they have asked you what level of access you want to provide to potential buyers. There are four elements to a quality listing. At the top of the list is Access, followed by Condition, Financing, and Price. There are many levels of access that you can provide to your agent so that he or she can show your home.Here are five levels of access that you can give to buyers, along with a brief description:

- Lockbox on the Door – this allows buyers the ability to see the home as soon as they are aware of the listing, or at their convenience.

- Providing a Key to the Home – although the buyer’s agent may need to stop by an office to pick up the key, there is little delay in being able to show the home.

- Open Access with a Phone Call – the seller allows showing with just a phone call’s notice.

- By Appointment Only (example: 48 Hour Notice) – Many buyers who are relocating for a new career or promotion start working in that area prior to purchasing their home. They often like to take advantage of free time during business hours (such as their lunch break) to view potential homes. Because of this, they may not be able to plan their availability far in advance or may be unable to wait 48 hours to see the house.

- Limited Access (example: the home is only available on Mondays or Tuesdays at 2pm or for only a couple of hours a day) - This is the most difficult way to be able to show your house to potential buyers.

In a competitive marketplace, access can make or break your ability to get the price you are looking for, or even sell your house at all.

Monday, February 20, 2017

Buying a home makes sense socially and financially, as rents are

predicted to increase substantially in the next year. Protect yourself

from rising rents by locking in your housing cost with a mortgage

payment now. timgrissett.com

Friday, February 17, 2017

Do You Know the Real Cost of Renting vs. Buying?

Some Highlights:

- Historically, the choice between renting or buying a home has been a close decision.

- Looking at the percentage of income needed to rent a median-priced home today (30%), vs. the percentage needed to buy a median-priced home (15%), the choice becomes obvious.

- Every market is different. Before you renew your lease again, find out if you could use your housing costs to own a home of your own!

Thursday, February 16, 2017

Flooded with natural sunlight and drenched in warm neutral earth tones! What do you think of this wall of windows? timgrissett.com

Wednesday, February 15, 2017

Tuesday, February 14, 2017

First Comes Love... Then Comes Mortgage?

According to the National Association of REALTORS most recent Profile of Home Buyers & Sellers,

married couples once again dominated the first-time homebuyer

statistics in 2016 at 58% of all buyers. It is no surprise that having

two incomes to save for down payments and contribute to monthly housing

costs makes buying a home more attainable.

But, many couples are also deciding to buy a home before spending what

would be a down payment on a wedding, as unmarried couples made up 14%

of all first-time buyers last year.

If you’re single, don’t fret! Single women made up 18% of first-time buyers in 2016, while single men accounted for 8% of buyers. One recent article pointed to a sense of responsibility and commitment that drives many single women to want to own their home, rather than rent.

Here is the breakdown of all first-time homebuyers in 2016 by percentage of all buyers, income, and age:

Bottom Line

You may not be that much different than those who have already purchased

their first homes. Meet with a local real estate professional today who

can help determine if your dream home is already within your grasp.

#RealtorPets

When making decisions about buying, selling or renovating their homes,

Americans take their pets pretty seriously. This according to a report

out Monday from the National Association of Realtors®. The 2017 Animal

House: Remodeling Impact report found that 81% of respondents said that

animal-related considerations play a role when deciding on their next

living situation.

Monday, February 13, 2017

3 Questions to Ask If You Want to Buy Your Dream Home

If you are debating purchasing a home right now, you are probably

getting a lot of advice. Though your friends and family will have your

best interest at heart, they may not be fully aware of your needs and

what is currently happening in the real estate market.

Ask yourself the following 3 questions to help determine if now is a

good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money. For example, a survey by Braun showed that over 75% of parents say “their child’s education is an important part of the search for a new home.” This survey supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. They are:- A good place to raise children and for them to get a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in December (the latest data available) was $232,200, up 4.0% from last year. This increase also marks the 58th consecutive month with year-over-year gains. If we look at the numbers year over year, CoreLogic forecasted a rise by 4.7% from December 2016 to December 2017. On a home that costs $250,000 today, that same home will cost you an additional $11,750 if you wait until next year.What does that mean to you?

Simply put, with prices increasing each month, it might cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates. The Mortgage Bankers Association (MBA), the National Association of Realtors, and Fannie Mae have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.Friday, February 10, 2017

5 Reasons to LOVE Using A Real Estate Professional

Hiring a real estate professional to guide you through the process of

buying a home or selling your house can be one of the best decisions you

make! We are there for you to help with paperwork, explaining the

process, negotiations, and helping you with pricing (both when making an

offer or setting the right price for your home). One of the top reasons

to hire a real estate professional is our understanding of your local

market and how the conditions in your neighborhood will impact your

experience. timgrissett.com

#IntownAtlanta

2 new spots coming to former H Harper Station space from Lady Bird Atlanta's Michael Lennox: Tavern Golden Eagle & Taco Shop Muchacho!

Thursday, February 9, 2017

Find Your Home In The City!

Downtown Atlanta is a thriving place with a growing residential population and office workers, as well as students, visitors and conventioneers. Downtown Atlanta is attracting people from a host of different walks of life, different areas of the city, and different income levels. Downtown residents walk to work while others sit in traffic; they enjoy incredible views of skylines and parks while others view sprawling parking lots of discount malls. Downtown residents even get world-class entertainment and sporting events delivered to their front yard versus ordering pay per view. Whether you are looking for world-class musical artists, avant-garde art galleries, or your favorite professional sports team, look for them in Downtown. Over 100 dining establishments, several shopping venues, and more than twenty attractions within a four square mile area, make Downtown a happening place to live.

Wednesday, February 8, 2017

Why Do Some Homes Sell Faster Than Others?

Have you ever wondered why some homes sell faster than others? Discover real estate secrets to help your home fly off the market!

Tuesday, February 7, 2017

Kitchens!

What do you think of this kitchen? Contact me today and let's see if I can help you find your dream kitchen and dream home!

Monday, February 6, 2017

4 Tips To Sell Your Home Quickly

A quick and profitable sale is the goal in mind when selling your home.

Who doesn’t want their home to sell quickly and for the best price? timgrissett.com

15 vs 30 Year Fixed Rate Mortgage

The main differences between 15- and 30-year loans are straightforward. Fifteen-year loans have higher monthly payments, but you pay less interest, while 30-year terms have lower monthly payments, but you pay significantly more for the house in the long run.

Friday, February 3, 2017

Get Ready to Buy A House

Still a ways away from buying, but want to be responsible? No matter

your timeline, these tips will help every aspiring homeowner get ready…

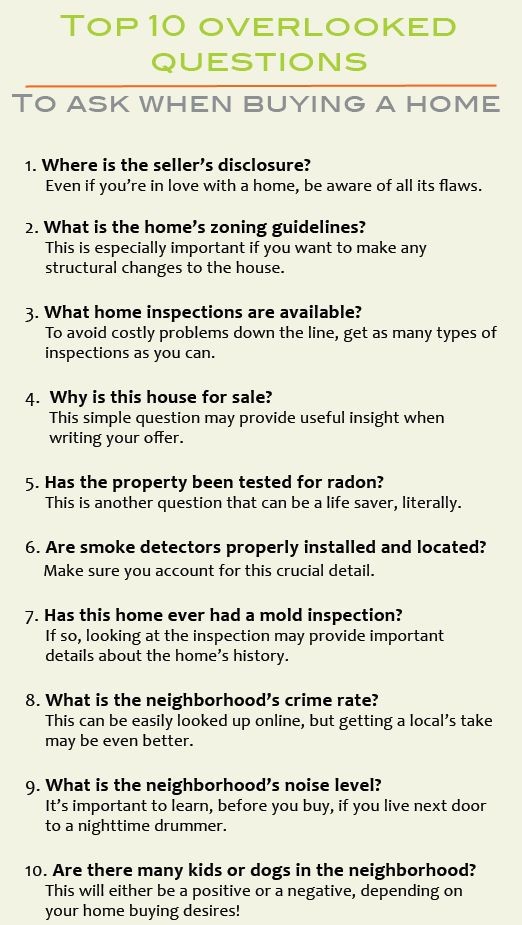

Top 10 Overlooked Questions To Ask When Buying A Home

Buying a home can be overwhelming. So many things to know and so many questions to ask. Check out our list of Top 10 Overlooked Questions to Ask When Buying a Home-- they might come in handy! Call me if you still have questions!

Thursday, February 2, 2017

How To Save For A Downpayment

Saving for a new home has just become easier. Both Fannie Mae and

Freddie Mac say they will now buy mortgages with as little as 3% down, a

big drop from the old 5% minimum. Even though conforming loans are now

easier to qualify for because down payment requirements have been

reduced, there’s still the matter of saving not only for a down payment

but also for closing costs and a reserve fund for the inevitable repairs

and other expenses that come with home ownership.

Wednesday, February 1, 2017

Subscribe to:

Comments (Atom)